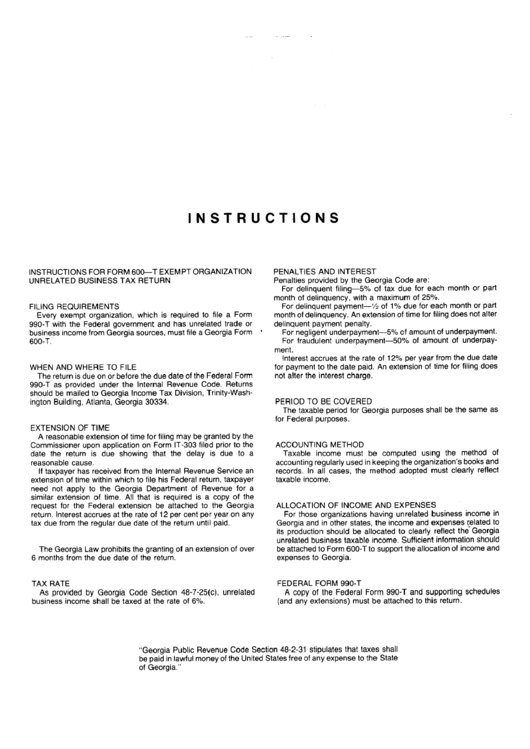

Instructions For Form 600-T Exempt Organization Unrelated Business Tax Return

ADVERTISEMENT

INSTRUCTIONS

INSTRUCTIONS

FORFORM 600-T EXEMPT ORGANIZATION

UNRELATED

BUSINESS T AX RETURN

FILING REQUIREMENTS

Everyexemptorganization, whichis required to filea Form

990-Twiththe Federalgovernment and has unrelated tradeor

business income f rom Georgia sources, m ustfilea Georgia Form

600-T.

WHEN AND WHERE TOFILE

Thereturn isdueonorbefore theduedateoftheFederal F orm

990-Tas provided underthe Internal R evenueCode.Returns

should be mailed to Georgia Income TaxDivision, Trinity-Wash-

ington Building, Atlanta, Georgia 30334.

EXTENSION OFTIME

Areasonable e xtension o ftimeforfiling maybegranted bythe

Commissioner uponapplication on FormIT-303 filedprior tothe

date the returnis due showingthat the delay is due to a

reasonable c ause.

Iftaxpayer h as received fromthe Internal R evenue Service an

extension o ftimewithin which tofilehisFederal r eturn, t axpayer

need not applyto the GeorgiaDepartment of Revenuefor a

similar e xtension of time,Allthat is requiredis a copyof the

requestforthe Federalextensionbe attachedto the Georgia

return. I nterest a ccruesattherateof12percentperyearonany

taxduefromthe regular d uedateofthe returnuntil p aid.

TheGeorgia Lawprohibits thegranting ofanextension o fover

6 months fromtheduedateofthe return.

PENALTIES AND INTEREST

Penalties p rovided b ytheGeorgia Codeare:

Fordelinquent filing—50/~

of tax due foreach monthor part

month ofdelinquency, witha maximum of25%

Fordelinquent payment—1/2

of 1%dueforeachmonth or part

month ofdelinquency. Anextension o ftimeforfiling d oesnotalter

delinquent payment p enalty.

Fornegligent underpayment—5%

ofamount o funderpayment.

Forfraudulent underpayment—50%

of amountof underpay-

ment.

Interest a ccruesat therateof12%peryearfrom theduedate

forpayment to thedatepaid.Anextension oftimeforfiling does

notalterthe interest c harge.

PERIOD TOBECOVERED

Thetaxable period forGeorgia purposes shallbethesameas

forFederal p urposes.

ACCOUNTING

METHOD

Taxableincomemust be computedusing the methodof

accounting regularly u sedinkeeping theorganization’s books and

records.In allcases, the methodadoptedmustclearlyreflect

taxable income.

ALLOCATION

OFINCOME A ND EXPENSES

Forthoseorganizations havingunrelated businessincome in

Georgia andinotherstates,theincome andexpensesrelated to

its production s houldbe allocated to clearly reflect t he Georgia

unrelated businesstaxableincome, S ufficient information should

beattached toForm 600-T tosupport t heallocation ofincome a nd

expensesto Georgia.

TAX RATE

FEDERAL FORM 990-T

As provided by GeorgiaCodeSection48-7-25(c), unrelated

Acopyofthe FederalForm990-Tand supporting s chedules

businessincome shallbe taxedat the rateof6%.

(andanyextensions) mustbe attached to thisreturn.

“Georgia Public Revenue CodeSection 48-2-31 stipulates t hattaxesshall

bepaidinlawful money oftheUnited Statesfreeofanyexpensetothe State

ofGeorgia. ”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1