Utility Users Tax Remittance Form - City Of Compton

ADVERTISEMENT

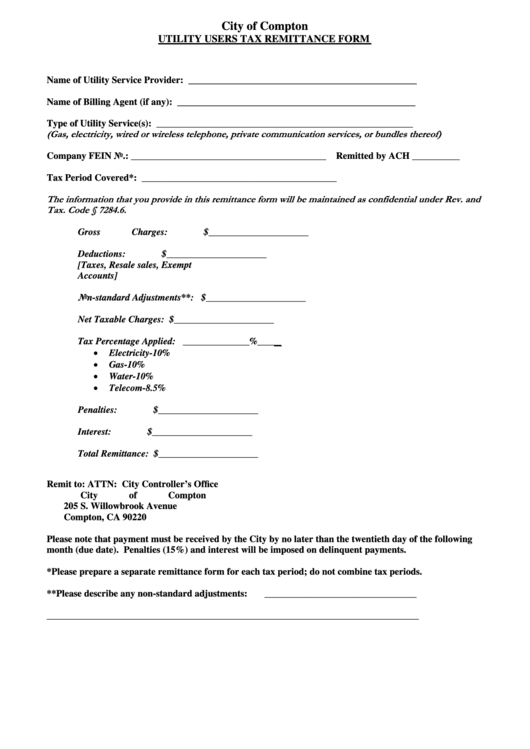

City of Compton

UTILITY USERS TAX REMITTANCE FORM

Name of Utility Service Provider: ________________________________________________

Name of Billing Agent (if any): __________________________________________________

Type of Utility Service(s): ______________________________________________________

(Gas, electricity, wired or wireless telephone, private communication services, or bundles thereof)

Company FEIN No.: _________________________________________ Remitted by ACH __________

Tax Period Covered*: _________________________________________

The information that you provide in this remittance form will be maintained as confidential under Rev. and

Tax. Code § 7284.6.

Gross Charges:

$_____________________

Deductions:

$_____________________

[Taxes, Resale sales, Exempt

Accounts]

Non-standard Adjustments**: $_____________________

Net Taxable Charges:

$_____________________

Tax Percentage Applied:

______________%_____

•

Electricity-10%

•

Gas-10%

•

Water-10%

•

Telecom-8.5%

Penalties:

$_____________________

Interest:

$_____________________

Total Remittance:

$_____________________

Remit to:

ATTN: City Controller’s Office

City of Compton

205 S. Willowbrook Avenue

Compton, CA 90220

Please note that payment must be received by the City by no later than the twentieth day of the following

month (due date). Penalties (15%) and interest will be imposed on delinquent payments.

*Please prepare a separate remittance form for each tax period; do not combine tax periods.

**Please describe any non-standard adjustments:

________________________________

______________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1