Utility Users Tax Remittance Form - City Of El Monte

ADVERTISEMENT

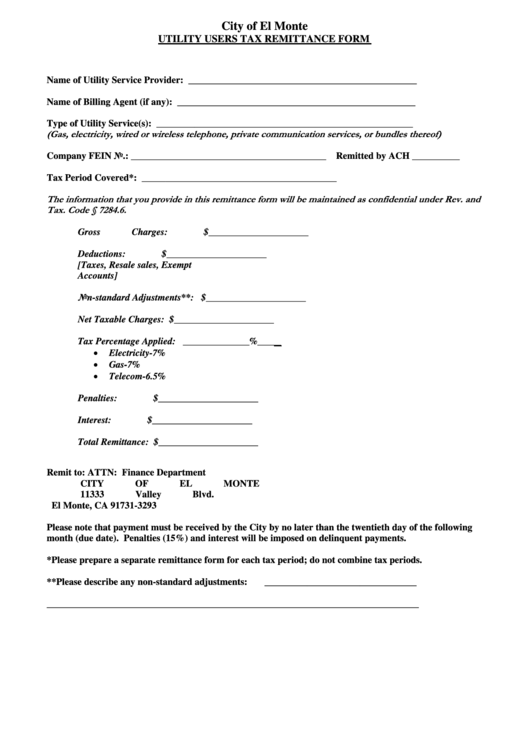

City of El Monte

UTILITY USERS TAX REMITTANCE FORM

Name of Utility Service Provider: ________________________________________________

Name of Billing Agent (if any): __________________________________________________

Type of Utility Service(s): ______________________________________________________

(Gas, electricity, wired or wireless telephone, private communication services, or bundles thereof)

Company FEIN No.: _________________________________________ Remitted by ACH __________

Tax Period Covered*: _________________________________________

The information that you provide in this remittance form will be maintained as confidential under Rev. and

Tax. Code § 7284.6.

Gross Charges:

$_____________________

Deductions:

$_____________________

[Taxes, Resale sales, Exempt

Accounts]

Non-standard Adjustments**: $_____________________

Net Taxable Charges:

$_____________________

Tax Percentage Applied:

______________%_____

•

Electricity-7%

•

Gas-7%

•

Telecom-6.5%

Penalties:

$_____________________

Interest:

$_____________________

Total Remittance:

$_____________________

Remit to:

ATTN: Finance Department

CITY OF EL MONTE

11333 Valley Blvd.

El Monte, CA 91731-3293

Please note that payment must be received by the City by no later than the twentieth day of the following

month (due date). Penalties (15%) and interest will be imposed on delinquent payments.

*Please prepare a separate remittance form for each tax period; do not combine tax periods.

**Please describe any non-standard adjustments:

________________________________

______________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1