Taxpayer Name and Address

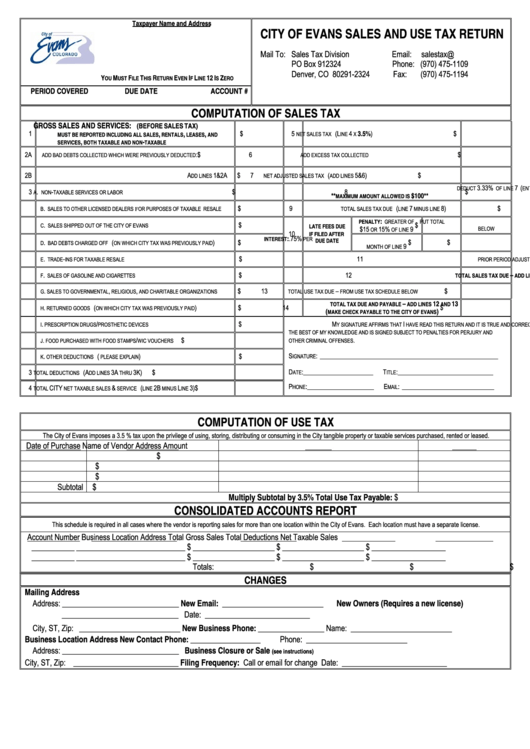

CITY OF EVANS SALES AND USE TAX RETURN

Mail To: Sales Tax Division

Email:

salestax@evanscolorado.gov

PO Box 912324

Phone: (970) 475-1109

Denver, CO 80291-2324

Fax:

(970) 475-1194

Y

M

F

T

R

E

I

L

12 I

Z

OU

UST

ILE

HIS

ETURN

VEN

F

INE

S

ERO

PERIOD COVERED

DUE DATE

ACCOUNT #

COMPUTATION OF SALES TAX

GROSS SALES AND SERVICES:

(BEFORE SALES TAX)

1

$

5

(L

4

$

3.5%)

,

,

,

NET SALES TAX

INE

X

MUST BE REPORTED INCLUDING ALL SALES

RENTALS

LEASES

AND

,

-

SERVICES

BOTH TAXABLE AND NON

TAXABLE

2A

:

$

6

$

ADD BAD DEBTS COLLECTED WHICH WERE PREVIOUSLY DEDUCTED

ADD EXCESS TAX COLLECTED

2B

A

1 & 2A

$

7

(

5 & 6)

$

DD LINES

NET ADJUSTED SALES TAX

ADD LINES

3.33%

7 (

0

)

DEDUCT

OF LINE

ENTER

IF RETURN IS FILED LATE

3

.

-

$

8

$

A

NON

TAXABLE SERVICES OR LABOR

**

$100**

MAXIMUM AMOUNT ALLOWED IS

.

$

9

(

7

8)

$

B

SALES TO OTHER LICENSED DEALERS FOR PURPOSES OF TAXABLE RESALE

TOTAL SALES TAX DUE

LINE

MINUS LINE

:

GREATER OF

PUT TOTAL

PENALTY

.

$

$

C

SALES SHIPPED OUT OF THE CITY OF EVANS

LATE FEES DUE

$15

15%

9

OR

OF LINE

BELOW

10

IF FILED AFTER

: .75%

PER

INTEREST

.

(

)

$

$

$

D

BAD DEBTS CHARGED OFF

ON WHICH CITY TAX WAS PREVIOUSLY PAID

DUE DATE

9

MONTH OF LINE

.

-

$

11

$

E

TRADE

INS FOR TAXABLE RESALE

PRIOR PERIOD ADJUSTMENT FOR OVER OR UNDERPAYMENTS

.

$

12

$

F

SALES OF GASOLINE AND CIGARETTES

–

9

11

TOTAL SALES TAX DUE

ADD LINES

THROUGH

.

,

,

$

13

–

$

G

SALES TO GOVERNMENTAL

RELIGIOUS

AND CHARITABLE ORGANIZATIONS

TOTAL USE TAX DUE

FROM USE TAX SCHEDULE BELOW

–

12

13

TOTAL TAX DUE AND PAYABLE

ADD LINES

AND

.

(

)

$

14

$

H

RETURNED GOODS

ON WHICH CITY TAX WAS PREVIOUSLY PAID

(

)

MAKE CHECK PAYABLE TO THE CITY OF EVANS

.

/

$

M

I

I

PRESCRIPTION DRUGS

PROSTHETIC DEVICES

Y SIGNATURE AFFIRMS THAT

HAVE READ THIS RETURN AND IT IS TRUE AND CORRECT TO

THE BEST OF MY KNOWLEDGE AND IS SIGNED SUBJECT TO PENALTIES FOR PERJURY AND

.

.

/

$

J

FOOD PURCHASED WITH FOOD STAMPS

WIC VOUCHERS

OTHER CRIMINAL OFFENSES

S

: ________________________________________________________

.

(

)

$

K

OTHER DEDUCTIONS

PLEASE EXPLAIN

IGNATURE

D

: ______________________

T

: ______________________________

3

(A

3A

3K)

$

ATE

ITLE

TOTAL DEDUCTIONS

DD LINES

THRU

P

: _____________________

E

: _____________________________

4

CITY

&

(

2B

L

3)

$

HONE

MAIL

TOTAL

NET TAXABLE SALES

SERVICE

LINE

MINUS

INE

COMPUTATION OF USE TAX

The City of Evans imposes a 3.5 % tax upon the privilege of using, storing, distributing or consuming in the City tangible property or taxable services purchased, rented or leased.

Date of Purchase

Name of Vendor

Address

Amount

$

$

$

Subtotal

$

$

Multiply Subtotal by 3.5%

Total Use Tax Payable:

CONSOLIDATED ACCOUNTS REPORT

This schedule is required in all cases where the vendor is reporting sales for more than one location within the City of Evans. Each location must have a separate license.

Account Number

Business Location Address

Total Gross Sales

Total Deductions

Net Taxable Sales

___________

____________________________

$ _____________________

$ _____________________

$ ___________________

___________

____________________________

$ _____________________

$ _____________________

$ ___________________

Totals:

$

$

$

CHANGES

Mailing Address

Address: ______________________________

New Email: __________________________

New Owners (Requires a new license)

______________________________

Date: ___________________________

City, ST, Zip: __________________________

New Business Phone: _________________

Name: __________________________

New Contact Phone: __________________

Phone: __________________________

Business Location Address

Address: ______________________________

Business Closure or Sale

(see instructions)

City, ST, Zip: ___________________________

Filing Frequency: Call or email for change

Date: ___________________________

1

1 2

2