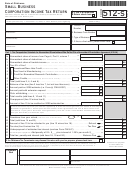

Part 2:

Ordinary Income from Trade or Business

Complete Column A. Column B should be completed by S Corporations whose income is all within Okla-

homa and/or by those whose income is partly within and partly without Oklahoma (not of a unitary nature).

Column A

Column B

CAUTION: Include only trade or business income and expenses on lines 1a through 21 below.

As reported on

Total applicable

Federal Return

1

a. Gross receipts or sales . . . . . .$___________

to Oklahoma

b. Minus returns and allowances $___________ = . . . . . . . . . . . . . . . . . . . .

00

00

1

2

Cost of goods sold and/or operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

2

3

Gross profit (subtract line 2 from line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

3

4

Net gain (loss) (Form 4797 Part II, line 17). . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

4

5

Other income (loss) (enclose schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

5

6

Total income (loss)

(add lines 3 through

5) . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

6

7

Compensation of officers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

7

8

Salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

8

9

Repairs and maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

9

10

Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

10

11

Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

11

12

Taxes and licenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

12

13

Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

13

14

Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

14

15

Depletion (do not deduct oil and gas depletion) . . . . . . . . . . . . . . . . . . . . . . . .

00

00

15

16

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

16

17

Pension, profit-sharing, etc. plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

17

18

Employee benefit programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

18

19

Other deductions (enclose schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

19

20

Total deductions

(add lines 7 through

19) . . . . . . . . . . . . . . . . . . . . . . . . . .

00

20

00

21

Ordinary Income (Loss) from trade or business:

00

00

Subtract line 20 from line

6. Enter here and below on Part 3, line 1 . . . . . . .

21

Part 3:

Shareholders’ Pro Rata Share Items

Column A

Column B

As reported on

Total applicable

Income

(lines 1 through 11)

Federal Return

to Oklahoma

1

Ordinary income (loss) from trade or business (from above on Part 2, line 21) .

00

00

1

00

2

Net income (loss) from rental estate activity(ies) (enclose schedule) . . . . . . . .

00

2

00

3

Net income (loss) from other rental activity(ies) (enclose schedule) . . . . . . . . .

00

3

4

Interest income

00

a: Interest on loans, notes, mortgages, bonds, etc. . . . . . . . . . . . . . . . . . . . .

00

4a

b: Interest on obligations of a state or political subdivision . . . . . . . . . . . . . .

00

4b

c: Interest on obligations of the United States . . . . . . . . . . . . . . . . . . . . . . . .

00

4c

00

d: Other interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

4d

00

5

Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

5

00

6

Royalties . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

6

00

7

Net short-term capital gain (loss) (Schedule D, 1120-S) . . . . . . . . . . . . . . . . .

00

7

8

Net long-term capital gain (loss) (Schedule D, 1120-S) . . . . . . . . . . . . . . . . .

00

00

8

00

9

Net gain (loss) under Section 1231 (other than due to casualty or theft) . . . . .

00

9

00

10

Other (enclose schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

10

11

Total income (add lines 1 through 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

11

Deductions

(lines 12 through 17)

00

12

Section 179 deduction (enclose schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

12

13

Contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

13

00

14

Deductions related to portfolio income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

14

15

Intangible drilling costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

15

00

16

Other deductions authorized by law (enclose schedule) . . . . . . . . . . . . . . . . .

00

16

00

17

Total Deductions (add lines 12 through 16) . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

17

Total

(line 18)

00

18

Net distributable income (line 11 minus line 17) . . . . . . . . . . . . . . . . . . . . . . . .

00

18

If Federal and Oklahoma distributable net incomes are the same, please see instructions on page 6 of packet.

1

1 2

2 3

3 4

4