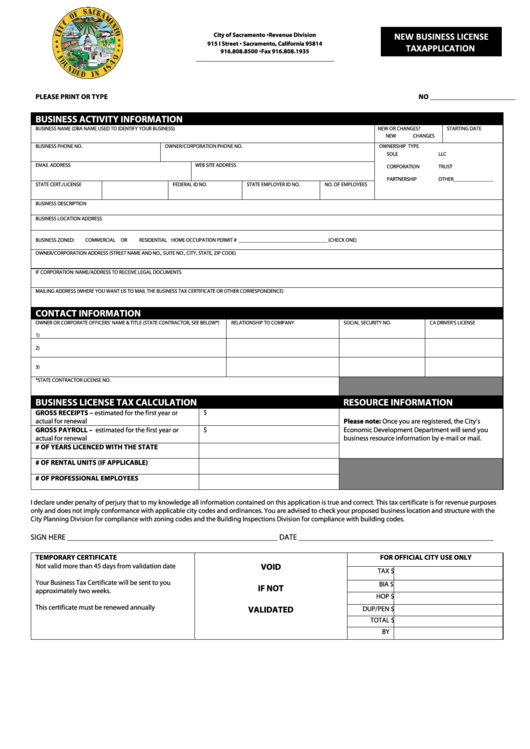

City of Sacramento ▪ Revenue Division

NEW BUSINESS LICENSE

915 I Street ▪ Sacramento, California 95814

TAX APPLICATION

916.808.8500 ▪ Fax 916.808.1935

PLEASE PRINT OR TYPE

NO ________________________

BUSINESS ACTIVITY INFORMATION

BUSINESS NAME (DBA NAME USED TO IDENTIFY YOUR BUSINESS)

NEW OR CHANGES?

STARTING DATE

NEW

CHANGES

BUSINESS PHONE NO.

OWNER/CORPORATION PHONE NO.

OWNERSHIP TYPE

SOLE

LLC

EMAIL ADDRESS

WEB SITE ADDRESS

CORPORATION

TRUST

PARTNERSHIP

OTHER_______________

STATE CERT./LICENSE NO.

EXP. DATE

FEDERAL ID NO.

STATE EMPLOYER ID NO.

NO. OF EMPLOYEES

BUSINESS DESCRIPTION

BUSINESS LOCATION ADDRESS

BUSINESS ZONED:

COMMERCIAL

OR

RESIDENTIAL HOME OCCUPATION PERMIT # _________________________________ (CHECK ONE)

OWNER/CORPORATION ADDRESS (STREET NAME AND NO., SUITE NO., CITY, STATE, ZIP CODE)

IF CORPORATION: NAME/ADDRESS TO RECEIVE LEGAL DOCUMENTS

MAILING ADDRESS (WHERE YOU WANT US TO MAIL THE BUSINESS TAX CERTIFICATE OR OTHER CORRESPONDENCE)

CONTACT INFORMATION

OWNER OR CORPORATE OFFICERS’ NAME & TITLE (STATE CONTRACTOR, SEE BELOW*)

RELATIONSHIP TO COMPANY

SOCIAL SECURITY NO.

CA DRIVER’S LICENSE

1)

2)

3)

*STATE CONTRACTOR LICENSE NO.

BUSINESS LICENSE TAX CALCULATION

RESOURCE INFORMATION

GROSS RECEIPTS – estimated for the first year or

$

actual for renewal

Please note: Once you are registered, the City’s

GROSS PAYROLL – estimated for the first year or

$

Economic Development Department will send you

business resource information by e-mail or mail.

actual for renewal

# OF YEARS LICENCED WITH THE STATE

# OF RENTAL UNITS (IF APPLICABLE)

# OF PROFESSIONAL EMPLOYEES

I declare under penalty of perjury that to my knowledge all information contained on this application is true and correct. This tax certificate is for revenue purposes

only and does not imply conformance with applicable city codes and ordinances. You are advised to check your proposed business location and structure with the

City Planning Division for compliance with zoning codes and the Building Inspections Division for compliance with building codes.

SIGN HERE ______________________________________________________ DATE __________________________________________________

TEMPORARY CERTIFICATE

FOR OFFICIAL CITY USE ONLY

VOID

Not valid more than 45 days from validation date

TAX

$

Your Business Tax Certificate will be sent to you

BIA

$

IF NOT

approximately two weeks.

HOP

$

This certificate must be renewed annually

VALIDATED

DUP/PEN

$

TOTAL

$

BY

1

1