Form 990 - Instructions For Schedule R - 2010

ADVERTISEMENT

2010

Department of the Treasury

Internal Revenue Service

Instructions for Schedule R

(Form 990)

Related Organizations and Unrelated Partnerships

Part IV requires identifying information on

Definition of Control) the filing

Section references are to the Internal

any related organization that is treated for

organization.

Revenue Code unless otherwise noted.

•

federal tax purposes as a C or S

Subsidiary — an organization controlled

General Instructions

corporation or trust. Part V requires

by the filing organization.

•

information on transactions between the

Brother/Sister — an organization

Note. Terms in bold are defined in the

organization and related organizations

controlled by the same person or persons

Glossary of the Instructions for Form 990.

(excluding disregarded entities). Part VI

that control the filing organization.

•

requires information on an unrelated

Supporting/Supported — an

Purpose of Schedule

organization taxable as a partnership

organization that is (or claims to be) at

any time during the organization’s tax

through which the organization conducted

Schedule R (Form 990) is used by an

year (i) a supporting organization of the

more than 5% of its activities (as

organization that files Form 990 to

described in Part VI).

filing organization within the meaning of

provide information on related

section 509(a)(3), if the filing organization

organizations, on certain transactions

Parts I-VI of Schedule R (Form 990)

is a supported organization within the

with related organizations, and on certain

may be duplicated if additional space is

meaning of section 509(f)(3), or (ii) a

unrelated partnerships through which the

needed to report additional related

supported organization, if the filing

organization conducts significant

organizations for Parts I-IV, additional

organization is a supporting organization.

activities.

transactions for Part V, or additional

•

Sponsoring Organization of a VEBA: an

unrelated organizations for Part VI. Use

organization that contributes 10% or more

Who Must File

as many duplicate copies as needed, and

of the contributions or payments made to

number each page of each part.

The chart below sets forth which

a section 501(c)(9) voluntary employees

organizations must complete all or a part

Part VII of Schedule R (Form 990)

beneficiary association (VEBA) during the

of Schedule R and attach Schedule R to

may be used to provide additional

tax year.

Form 990. If an organization is not

information in response to questions in

Disregarded entity exception.

required to file Form 990 but chooses to

Schedule R.

Disregarded entities are treated as

do so, it must file a complete return and

related organizations for purposes of

Relationships

provide all of the information requested,

reporting on Schedule R, Part I, but not

including the required schedules.

An organization, including a nonprofit

for purposes of reporting transactions with

organization, a stock corporation, a

related organizations in Part V, or

Overview

partnership or limited liability company, a

otherwise on Form 990. A disregarded

Part I requires identifying information on

trust, and a governmental unit or other

entity of an organization related to the

any organization that is treated for federal

government entity, is a related

filing organization is treated as part of the

tax purposes as a disregarded entity.

organization to the filing organization if it

related organization and not as a

Part II requires identifying information on

stands, at any time during the tax year, in

separate entity. See Appendix F in the

related tax-exempt organizations. Part III

one or more of the following relationships

Instructions for Form 990.

requires identifying information on any

to the filing organization.

Bank trustee exception. If the filing

•

related organization that is treated for

Parent — an organization that controls

organization is a trust that has a bank or

federal tax purposes as a partnership.

(see definitions of control under

financial institution trustee that is also the

trustee of another trust, the filing

organization is not required to report the

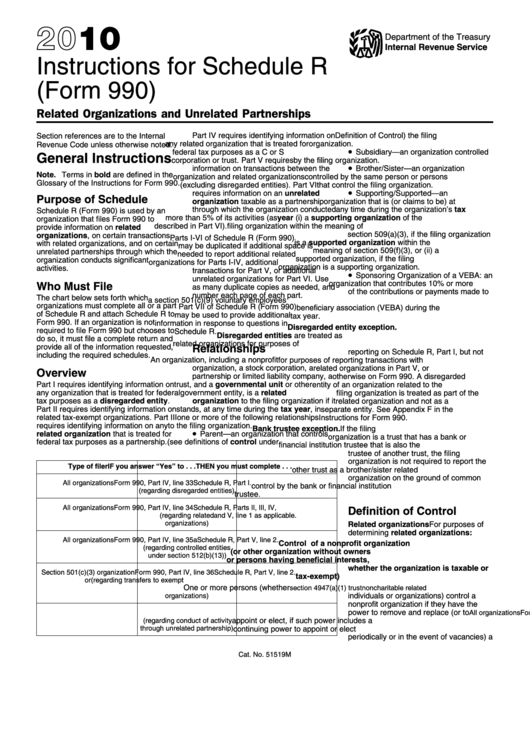

Type of filer

IF you answer “Yes” to . . .

THEN you must complete . . .

other trust as a brother/sister related

organization on the ground of common

All organizations

Form 990, Part IV, line 33

Schedule R, Part I.

control by the bank or financial institution

(regarding disregarded entities)

trustee.

All organizations

Form 990, Part IV, line 34

Schedule R, Parts II, III, IV,

Definition of Control

(regarding related

and V, line 1 as applicable.

organizations)

Related organizations For purposes of

determining related organizations:

All organizations

Form 990, Part IV, line 35a

Schedule R, Part V, line 2.

Control of a nonprofit organization

(regarding controlled entities

(or other organization without owners

under section 512(b)(13))

or persons having beneficial interests,

whether the organization is taxable or

Section 501(c)(3) organization

Form 990, Part IV, line 36

Schedule R, Part V, line 2.

tax-exempt)

or

(regarding transfers to exempt

One or more persons (whether

section 4947(a)(1) trust

noncharitable related

organizations)

individuals or organizations) control a

nonprofit organization if they have the

power to remove and replace (or to

All organizations

Form 990, Part IV, line 37

Schedule R, Part VI.

appoint or elect, if such power includes a

(regarding conduct of activity

through unrelated partnership)

continuing power to appoint or elect

periodically or in the event of vacancies) a

Cat. No. 51519M

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5