Form 72a067 - Application For Approval To Receive A Refund Of Aviation Motor Fuels - 2009

ADVERTISEMENT

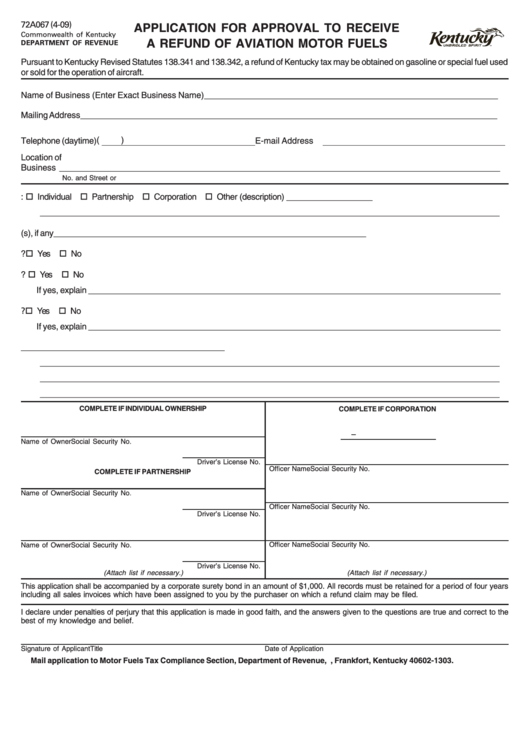

72A067 (4-09)

APPLICATION FOR APPROVAL TO RECEIVE

Commonwealth of Kentucky

A REFUND OF AVIATION MOTOR FUELS

DEPARTMENT OF REVENUE

Pursuant to Kentucky Revised Statutes 138.341 and 138.342, a refund of Kentucky tax may be obtained on gasoline or special fuel used

or sold for the operation of aircraft.

Name of Business (Enter Exact Business Name) ______________________________________________________________

Mailing Address ________________________________________________________________________________________

P .O. Box or No. and Street

City or Town

State

ZIP Code

Telephone (daytime) (

)

E-mail Address

Location of

Business _____________________________________________________________________________________________

No. and Street or Hwy.

City or Town

County and State

Name of Airport

1. Indicate type of ownership:

Individual

Partnership

Corporation

Other (description) ___________________

_________________________________________________________________________________________________

2. Give the name of previous owner(s), if any __________________________________________________________________

3. Can motor vehicles be fueled from these facilities?

Yes

No

4. Do you sell aviation gasoline or special fuel at this location for purposes other than use in aircraft?

Yes

No

If yes, explain _______________________________________________________________________________________

5. Do you sell aviation gasoline or special fuels at this location for purposes other than your own use?

Yes

No

If yes, explain _______________________________________________________________________________________

6. Give the name and address of all suppliers of aviation refund motor fuels ___________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

COMPLETE IF INDIVIDUAL OWNERSHIP

COMPLETE IF CORPORATION

–

Name of Owner

Social Security No.

F.E.I.N.

Driver’s License No.

Officer Name

Social Security No.

COMPLETE IF PARTNERSHIP

Name of Owner

Social Security No.

Officer Name

Social Security No.

Driver’s License No.

Officer Name

Social Security No.

Name of Owner

Social Security No.

Driver’s License No.

(Attach list if necessary.)

(Attach list if necessary.)

This application shall be accompanied by a corporate surety bond in an amount of $1,000. All records must be retained for a period of four years

including all sales invoices which have been assigned to you by the purchaser on which a refund claim may be filed.

I declare under penalties of perjury that this application is made in good faith, and the answers given to the questions are true and correct to the

best of my knowledge and belief.

Signature of Applicant

Title

Date of Application

Mail application to Motor Fuels Tax Compliance Section, Department of Revenue, P.O. Box 1303, Frankfort, Kentucky 40602-1303.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1