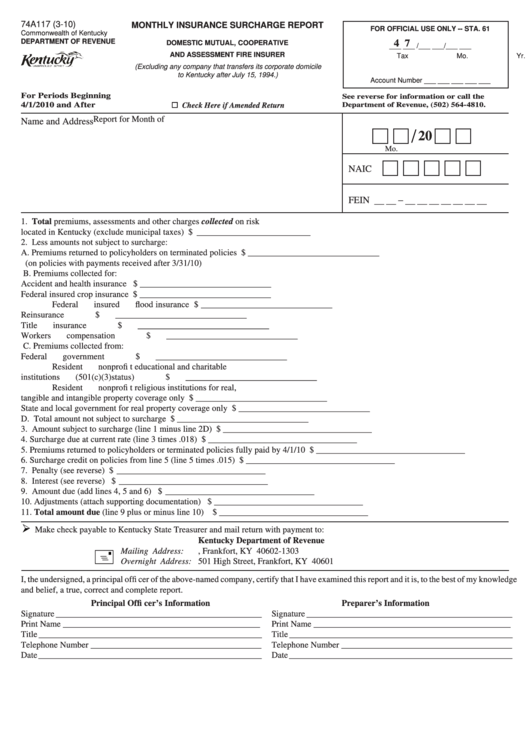

Form 74a117 - Monthly Insurance Surcharge Report

ADVERTISEMENT

74A117 (3-10)

MONTHLY INSURANCE SURCHARGE REPORT

FOR OFFICIAL USE ONLY -- STA. 61

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

4 7

DOMESTIC MUTUAL, COOPERATIVE

___ ___ /___ ___/___ ___

AND ASSESSMENT FIRE INSURER

Tax

Mo.

Yr.

(Excluding any company that transfers its corporate domicile

to Kentucky after July 15, 1994.)

Account Number ___ ___ ___ ___ ___

For Periods Beginning

See reverse for information or call the

4/1/2010 and After

Check Here if Amended Return

Department of Revenue, (502) 564-4810.

Report for Month of

Name and Address

/

20

Mo.

NAIC

FEIN

__ __ – __ __ __ __ __ __ __

1. Total premiums, assessments and other charges collected on risk

located in Kentucky (exclude municipal taxes) .................................................................................... $ __________________________

2. Less amounts not subject to surcharge:

A. Premiums returned to policyholders on terminated policies ........................... $ ______________________________

(on policies with payments received after 3/31/10)

B. Premiums collected for:

Accident and health insurance ........................................................................ $ ______________________________

Federal insured crop insurance ........................................................................ $ ______________________________

Federal insured fl ood insurance ....................................................................... $ ______________________________

Reinsurance ..................................................................................................... $ ______________________________

Title insurance ................................................................................................. $ ______________________________

Workers compensation .................................................................................... $ ______________________________

C. Premiums collected from:

Federal government ......................................................................................... $ ______________________________

Resident nonprofi t educational and charitable

institutions (501(c)(3)status) ........................................................................... $ ______________________________

Resident nonprofi t religious institutions for real,

tangible and intangible property coverage only .............................................. $ ______________________________

State and local government for real property coverage only ........................... $ ______________________________

D. Total amount not subject to surcharge ............................................................. $ ______________________________

3. Amount subject to surcharge (line 1 minus line 2D) ............................................................. $ __________________________________

4. Surcharge due at current rate (line 3 times .018) ................................................................... $ __________________________________

5. Premiums returned to policyholders or terminated policies fully paid by 4/1/10 ................. $ __________________________________

6. Surcharge credit on policies from line 5 (line 5 times .015) .................................................. $ __________________________________

7. Penalty (see reverse) .............................................................................................................. $ __________________________________

8. Interest (see reverse) ............................................................................................................. $ __________________________________

9. Amount due (add lines 4, 5 and 6) ......................................................................................... $ __________________________________

10. Adjustments (attach supporting documentation) .................................................................. $ __________________________________

11. Total amount due (line 9 plus or minus line 10) ................................................................ $ __________________________________

Make check payable to Kentucky State Treasurer and mail return with payment to:

Kentucky Department of Revenue

Mailing Address:

P.O. Box 1303, Frankfort, KY 40602-1303

Overnight Address:

501 High Street, Frankfort, KY 40601

I, the undersigned, a principal offi cer of the above-named company, certify that I have examined this report and it is, to the best of my knowledge

and belief, a true, correct and complete report.

Principal Offi cer’s Information

Preparer’s Information

Signature _______________________________________________

Signature _______________________________________________

Print Name _____________________________________________

Print Name _____________________________________________

Title ___________________________________________________

Title ___________________________________________________

Telephone Number _______________________________________

Telephone Number _______________________________________

Date ___________________________________________________

Date ___________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2