Print

Reset

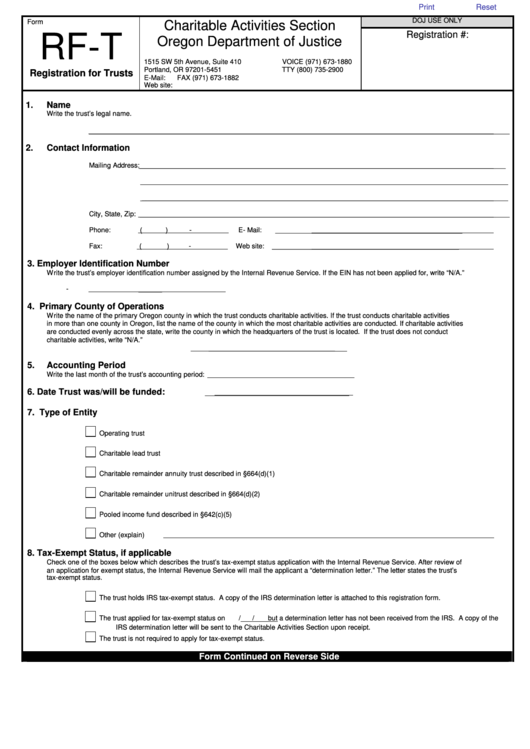

Form

Charitable Activities Section

DOJ USE ONLY

Registration #:

RF-T

Oregon Department of Justice

1515 SW 5th Avenue, Suite 410

VOICE

(971) 673-1880

Portland, OR 97201-5451

TTY

(800) 735-2900

Registration for Trusts

E-Mail: charitable.activities@doj.state.or.us

FAX

(971) 673-1882

Web site:

1.

Name

Write the trust’s legal name.

____________________________________________________________________________________________________________

2.

Contact Information

Mailing Address: ______________________________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

City, State, Zip: _______________________________________________________________________________________________

Phone:

(

)

-

E- Mail:

________________________________________________

Fax:

(

)

-

Web site:

________________________________________________

3.

Employer Identification Number

Write the trust’s employer identification number assigned by the Internal Revenue Service. If the EIN has not been applied for, write “N/A.”

-

______

4.

Primary County of Operations

Write the name of the primary Oregon county in which the trust conducts charitable activities. If the trust conducts charitable activities

in more than one county in Oregon, list the name of the county in which the most charitable activities are conducted. If charitable activities

are conducted evenly across the state, write the county in which the headquarters of the trust is located. If the trust does not conduct

charitable activities, write “N/A.”

_____________________________________

5.

Accounting Period

Write the last month of the trust’s accounting period: _____________________________________

6.

Date Trust was/will be funded:

_____________________________________

7.

Type of Entity

Operating trust

Charitable lead trust

Charitable remainder annuity trust described in §664(d)(1)

Charitable remainder unitrust described in §664(d)(2)

Pooled income fund described in §642(c)(5)

Other (explain)

8.

Tax-Exempt Status, if applicable

Check one of the boxes below which describes the trust’s tax-exempt status application with the Internal Revenue Service. After review of

an application for exempt status, the Internal Revenue Service will mail the applicant a “determination letter.” The letter states the trust’s

tax-exempt status.

The trust holds IRS tax-exempt status. A copy of the IRS determination letter is attached to this registration form.

The trust applied for tax-exempt status on

/

/

but a determination letter has not been received from the IRS. A copy of the

IRS determination letter will be sent to the Charitable Activities Section upon receipt.

The trust is not required to apply for tax-exempt status.

Form Continued on Reverse Side

1

1 2

2