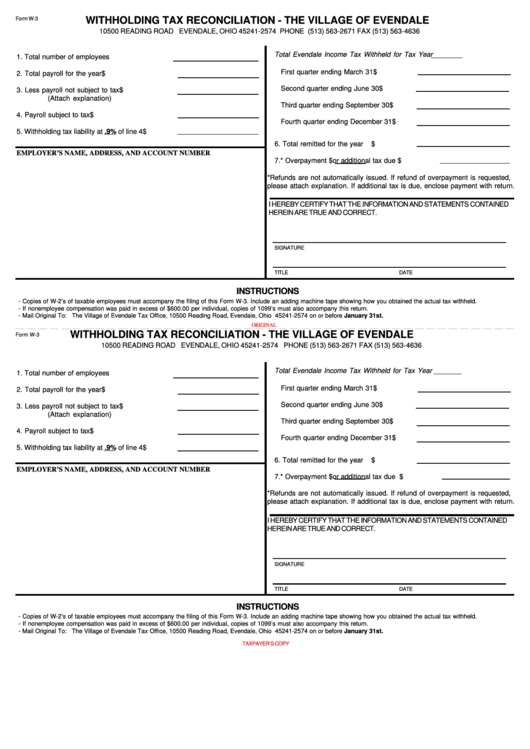

Form W-3 - Withholding Tax Reconciliation - The Village Of Evendale

ADVERTISEMENT

WITHHOLDING TAX RECONCILIATION - THE VILLAGE OF EVENDALE

Form W-3

10500 READING ROAD EVENDALE, OHIO 45241-2574 PHONE (513) 563-2671 FAX (513) 563-4636

Total Evendale Income Tax Withheld for Tax Year ________

1. Total number of employees

First quarter ending March 31

$

2. Total payroll for the year

$

Second quarter ending June 30

$

3. Less payroll not subject to tax

$

(Attach explanation)

Third quarter ending September 30

$

4. Payroll subject to tax

$

Fourth quarter ending December 31

$

5. Withholding tax liability at .9% of line 4

$

6. Total remitted for the year

$

EMPLOYER’S NAME, ADDRESS, AND ACCOUNT NUMBER

7.* Overpayment $

or additional tax due $

*Refunds are not automatically issued. If refund of overpayment is requested,

please attach explanation. If additional tax is due, enclose payment with return.

I HEREBY CERTIFY THAT THE INFORMATION AND STATEMENTS CONTAINED

HEREIN ARE TRUE AND CORRECT.

SIGNATURE

TITLE

DATE

INSTRUCTIONS

- Copies of W-2’s of taxable employees must accompany the filing of this Form W-3. Include an adding machine tape showing how you obtained the actual tax withheld.

- If nonemployee compensation was paid in excess of $600.00 per individual, copies of 1099’s must also accompany this return.

- Mail Original To: The Village of Evendale Tax Office, 10500 Reading Road, Evendale, Ohio 45241-2574 on or before January 31st.

ORIGINAL

WITHHOLDING TAX RECONCILIATION - THE VILLAGE OF EVENDALE

Form W-3

10500 READING ROAD EVENDALE, OHIO 45241-2574 PHONE (513) 563-2671 FAX (513) 563-4636

Total Evendale Income Tax Withheld for Tax Year _______

1. Total number of employees

First quarter ending March 31

$

2. Total payroll for the year

$

Second quarter ending June 30

$

3. Less payroll not subject to tax

$

(Attach explanation)

Third quarter ending September 30

$

4. Payroll subject to tax

$

Fourth quarter ending December 31

$

5. Withholding tax liability at .9% of line 4

$

6. Total remitted for the year

$

EMPLOYER’S NAME, ADDRESS, AND ACCOUNT NUMBER

7.* Overpayment $

or additional tax due $

*Refunds are not automatically issued. If refund of overpayment is requested,

please attach explanation. If additional tax is due, enclose payment with return.

I HEREBY CERTIFY THAT THE INFORMATION AND STATEMENTS CONTAINED

HEREIN ARE TRUE AND CORRECT.

SIGNATURE

TITLE

DATE

INSTRUCTIONS

- Copies of W-2’s of taxable employees must accompany the filing of this Form W-3. Include an adding machine tape showing how you obtained the actual tax withheld.

- If nonemployee compensation was paid in excess of $600.00 per individual, copies of 1099’s must also accompany this return.

- Mail Original To: The Village of Evendale Tax Office, 10500 Reading Road, Evendale, Ohio 45241-2574 on or before January 31st.

TAXPAYER’S COPY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1