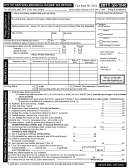

Form Gr-1040 - City Of Grayling Individual Income Tax Return - 2009 Page 2

ADVERTISEMENT

SCHEDULE 1 - COMPUTATION OF WAGES EARNED IN GRAYLING (NONRESIDENTS ONLY)

When both spouses have income subject to allocation, figure them separately. Also, a separate computation must be made for each W-2.

1. a. Number of days paid (5 days/week x 52 weeks = 260 days)

(if other than 260 days attach an explanation).

1a.___________.__

b. Vacation, holidays, sick, and other days not worked

1b.___________.__

c. Actual number of days worked everywhere (1a. minus 1b.)

1c. ____________days

2. Actual number of days worked in Grayling

2. ____________days

(Attach Statement from employer(s).)

3. Percentage of days worked in Grayling (line 2 divided by line 1c.)

3. _____________ %

4. Total wages shown on W-2

4. _____________.00

5. Wages earned in Grayling (line 4 x percentage on line 3).

Enter here and on GR-1040, line 7

5. ______________.00

6. Wages excluded from City of Grayling Income Tax (line 4 minus line 5).

6. ______________.00

SCHEDULE 2 - BUSINESS ALLOCATION (NONRESIDENTS ONLY)

If you are self employed and have income earned from your business both inside and outside the city, you must complete this schedule.

This schedule must be accompanied by a copy of your U.S. 1040, Schedule C and your worksheet (see page 6) used to show allocation.

1. Net income from business of profession

1. _____________.00

2. Percent earned in Grayling (Attach Schedule C and worksheet).

2. _____________ %

3. Business income subject to Grayling income tax (line 1 x percentage on line 2).

(enter here and on GR-1040, line 8).

3. _____________.00

SCHEDULE 3 - COMPUTATION OF WAGES FOR PART-YEAR RESIDENTS

This schedule applies only if you had income during the year 2009 as a

Column B

Column A

resident and nonresident. (See instructions on page 5).

Portion of income earned in City

All income while a City of

of Grayling while a nonresident

Grayling Resident

1.Gross wages. (Attach W-2).

1. _______________ .00

1. _______________ .00

2.Additions. (See instructions).

2. _______________ .00

2. _______________ .00

3.Subtractions. (See instructions).

3. (______________ .00

3. (______________ .00

4.Total income.

4. ______________ .00

4. ______________ .00

5.Less exemptions. ($3,000 for each exemption claimed)

(The sum of lines 5a and 5b may not exceed amount of GR-1040, line 12).

5. (_____________ .00

5. (_____________ .00

6.Taxable income. Subtract line 5 from line 4.

6. _____________ .00

6. _____________ .00

7.Tax. Resident income: multiply line 6, column a by 1% (.01)

7. _____________ .00

8.Tax. Nonresident income: multiply line 6 column b by 1/2% (.005)

8. _____________ .00

9.Total tax. Add lines 7 and 8. Enter here and on GR-1040, line 14.

9. _____________ .00

10.Resident on City of Grayling. Enter dates: From:____________To:___________.

Previous address in 2008.___________________________________________

I declare, under penalty of perjury, that this return is based on all

I declare, under penalty of perjury, the information in this return and attachments is true

information of which I have knowledge. Preparer’s Signature,

and complete to the best of my knowledge.

Address, Phone and ID No.

I authorize Treasury to discuss my return

Do not discuss my return with

and attachments with my preparer.

my preparer.

FILER’S SIGNATURE

DATE

SPOUSE’S SIGNATURE

DATE

Daytime phone for questions regarding your return:

Mail To:

City of Grayling

This return is due April 30, 2010 OR

on the 15th day of the fourth month after your tax year ends.

Income Tax Division

P.O. Box 549 • 1020 City Blvd.

Make your check or money order payable to: City Treasurer

Grayling, MI 49738

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2