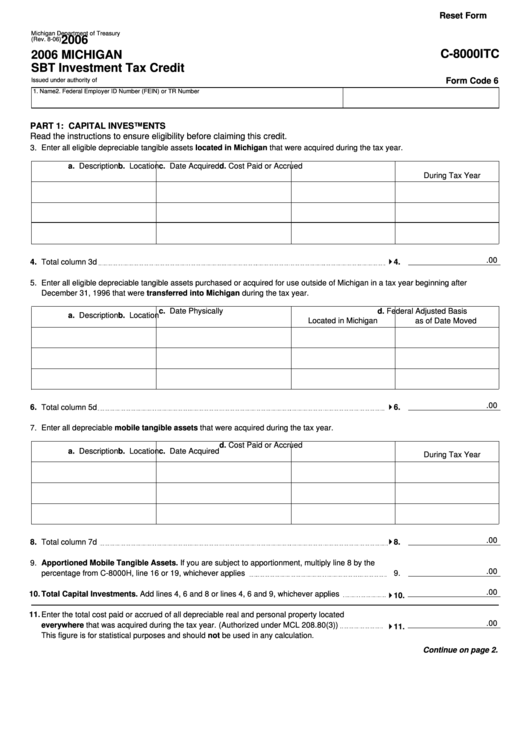

Reset Form

Michigan Department of Treasury

2006

(Rev. 8-06)

C-8000ITC

2006 MICHIGAN

SBT Investment Tax Credit

Issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

Form Code 6

1. Name

2. Federal Employer ID Number (FEIN) or TR Number

PART 1: CAPITAL INVESTMENTS

Read the instructions to ensure eligibility before claiming this credit.

3.

Enter all eligible depreciable tangible assets located in Michigan that were acquired during the tax year.

a. Description

b. Location

c. Date Acquired

d. Cost Paid or Accrued

During Tax Year

.00

4.

Total column 3d

4.

5.

Enter all eligible depreciable tangible assets purchased or acquired for use outside of Michigan in a tax year beginning after

December 31, 1996 that were transferred into Michigan during the tax year.

c. Date Physically

d. Federal Adjusted Basis

a. Description

b. Location

Located in Michigan

as of Date Moved

.00

6.

Total column 5d

6.

7.

Enter all depreciable mobile tangible assets that were acquired during the tax year.

d. Cost Paid or Accrued

a. Description

b. Location

c. Date Acquired

During Tax Year

.00

8.

Total column 7d

8.

9.

Apportioned Mobile Tangible Assets. If you are subject to apportionment, multiply line 8 by the

.00

percentage from C-8000H, line 16 or 19, whichever applies

9.

.00

10.

Total Capital Investments. Add lines 4, 6 and 8 or lines 4, 6 and 9, whichever applies

10.

11.

Enter the total cost paid or accrued of all depreciable real and personal property located

.00

everywhere that was acquired during the tax year. (Authorized under MCL 208.80(3))

11.

This figure is for statistical purposes and should not be used in any calculation.

Continue on page 2.

1

1 2

2