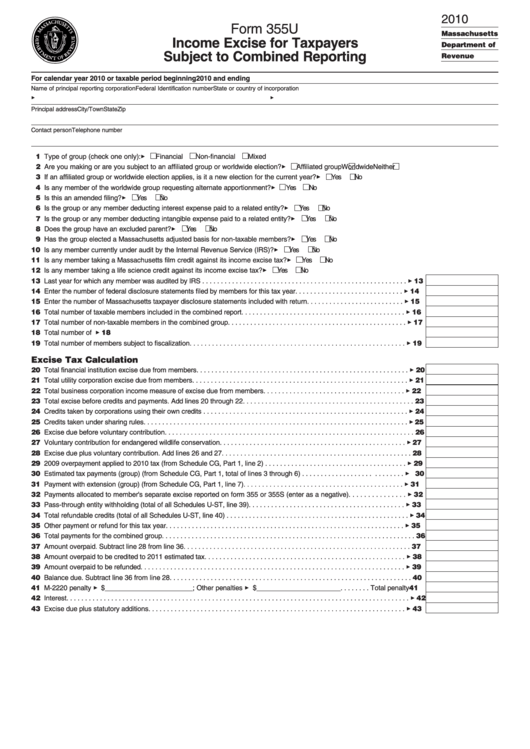

Form 355u - Income Excise For Taxpayers - Subject To Combined Reporting - 2010

ADVERTISEMENT

2010

Form 355U

Massachusetts

Income Excise for Taxpayers

Department of

Subject to Combined Reporting

Revenue

For calendar year 2010 or taxable period beginning

2010 and ending

Name of principal reporting corporation

Federal Identification number

State or country of incorporation

3

3

Principal address

City/Town

State

Zip

Contact person

Telephone number

11 Type of group (check one only): 3

Financial

Non-financial

Mixed

12 Are you making or are you subject to an affiliated group or worldwide election? 3

Affiliated group

Worldwide

Neither

13 If an affiliated group or worldwide election applies, is it a new election for the current year? 3

Yes

No

14 Is any member of the worldwide group requesting alternate apportionment? 3

Yes

No

15 Is this an amended filing? 3

Yes

No

16 Is the group or any member deducting interest expense paid to a related entity? 3

Yes

No

17 Is the group or any member deducting intangible expense paid to a related entity? 3

Yes

No

18 Does the group have an excluded parent? 3

Yes

No

19 Has the group elected a Massachusetts adjusted basis for non-taxable members? 3

Yes

No

10 Is any member currently under audit by the Internal Revenue Service (IRS)? 3

Yes

No

11 Is any member taking a Massachusetts film credit against its income excise tax? 3

Yes

No

12 Is any member taking a life science credit against its income excise tax? 3

Yes

No

13 Last year for which any member was audited by IRS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 13

14 Enter the number of federal disclosure statements filed by members for this tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 Enter the number of Massachusetts taxpayer disclosure statements included with return . . . . . . . . . . . . . . . . . . . . . . . . . . 3 15

16 Total number of taxable members included in the combined report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 16

17 Total number of non-taxable members in the combined group . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 17

18 Total number of U.S. Schedules M-3 filed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 18

19 Total number of members subject to fiscalization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 19

Excise Tax Calculation

20 Total financial institution excise due from members. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 20

21 Total utility corporation excise due from members . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 21

22 Total business corporation income measure of excise due from members . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 22

23 Total excise before credits and payments. Add lines 20 through 22. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Credits taken by corporations using their own credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 24

25 Credits taken under sharing rules . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 25

26 Excise due before voluntary contribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Voluntary contribution for endangered wildlife conservation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 27

28 Excise due plus voluntary contribution. Add lines 26 and 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 2009 overpayment applied to 2010 tax (from Schedule CG, Part 1, line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 29

30 Estimated tax payments (group) (from Schedule CG, Part 1, total of lines 3 through 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 30

31 Payment with extension (group) (from Schedule CG, Part 1, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 31

32 Payments allocated to member's separate excise reported on form 355 or 355S (enter as a negative) . . . . . . . . . . . . . . . 3 32

33 Pass-through entity withholding (total of all Schedules U-ST, line 39) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 33

34 Total refundable credits (total of all Schedules U-ST, line 40) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 34

35 Other payment or refund for this tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 35

36 Total payments for the combined group. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

37 Amount overpaid. Subtract line 28 from line 36 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

38 Amount overpaid to be credited to 2011 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 38

39 Amount overpaid to be refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 39

40 Balance due. Subtract line 36 from line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

41 M-2220 penalty 3 $ _______________________ ; Other penalties 3 $ ______________________. . . . . . . . Total penalty 41

42 Interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 42

43 Excise due plus statutory additions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 43

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1