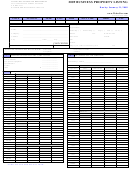

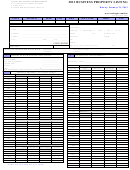

Business Assessment List Form - Stone County, Missouri - 2016 Page 2

ADVERTISEMENT

e.g. Auto, Truck, Tractor,

Ford F-150, etc.

LE

Crew

2-Dr

2WD

MODEL

VEHICLE / EQUIP. TYPE:

MAKE & MODEL

STYLE

# DRS

DRV

CAB

GVW /

# AXLES

LENGTH:

MO MILES

TOTAL

OFFICE USE

Trailer, Etc.

Ext.

4-Dr

4WD

YEAR

TONS

TRAILERS

MILES

ONLY

Sngl.

DESCRIPTION

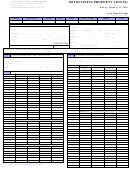

Y

E

A

R

MAKE

M

O

D

E

L

4

X

4

H

P

ENGINE (circle)

ORIG. COST

$

FORKLIFTS

YES

NO

Gas

Diesel

$

BACKHOES

Gas

Diesel

YES

NO

$

HEAVY

DOZERS

Gas

Diesel

YES

NO

EQUIPMENT

$

DRILLING EQUIPMENT

YES

NO

Gas

Diesel

$

O

THER CONST. EQUIP.

Gas

Diesel

YES

NO

$

TRACTOR

YES

NO

Gas

Diesel

$

BRUSH HOG

YES

NO

Gas

Diesel

Attach additional sheet if necessary.

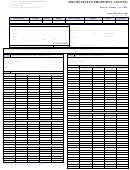

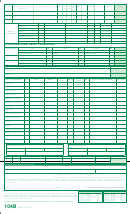

LIVESTOCK

TYPE

NO.

TYPE

NO.

TYPE

NO.

CALVES (0-11 mo.)

PIGS (0-120 lb.)

GOATS

COWS / BULLS (2+ yrs.)

BARROWS

DOGS (NOT PETS)

YEARLINGS (1 - 2 yrs.)

ASSES / JENNIES / MULES

LLAMA/ALPACA

LAMBS / SHEEP

SOWS / BOARS

OTHER LIVESTOCK

HORSES (2+ yrs.)

POULTRY

COLTS (1 - 2 yrs.)

EMU / OSTRICH

SLEEPERS / KITCHENETTES / HOTELS / MOTEL ROOMS

ASSESSOR

QUANTITY:

QUANTITY:

(Circle)

(Circle)

HULL MTL.

MOTOR TYPE

BOATS / WATERCRAFT

YEAR

MAKE

MODEL

LENGTH

HP

HULL ID / SERIAL NUMBER

OFFICE USE

FIBERGLASS

OUTBOARD

BASS BOAT

ALUM.

WOOD

I/O INBOARD

BASS BOAT

PONTOON BOAT

PONTOON BOAT

HOUSEBOAT / CRUISER

HOUSEBOAT / CRUISER

MISC. BOAT

MISC. BOAT

I / O BOAT / DECK BOAT

I / O BOAT / DECK BOAT

MOTORS

MOTORS

PERSONAL WATERCRAFT

PERSONAL WATERCRAFT

1

2

BOAT DOCK (PERMIT NO.)

BOAT DOCK (PERMIT NO.)

YEAR BUILT

LENGTH

WIDTH

YEAR BUILT

LENGTH

WIDTH

BOAT LIFT

BOAT LIFT

AIRPLANE

YEAR

MAKE

MODEL / TYPE

HR. / LAST YR.

MAX CERT.GROSS TAKEOFF WT.

PURCHASE

ASSESSOR

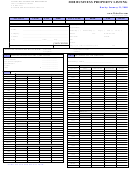

AGENT OR PREPARER'S INFORMATION

NAME

ADDRESS

CITY, STATE, ZIP CODE

TELEPHONE

TAX I.D. NUMBER

(

)

I, _____________________________________________________ ,

President

Treasurer

Owner

Manager

Other __________________________

of ______________________________________________________ , do solemnly swear, or affirm, that the foregoing list contains a true and correct statement of

all the tangible personal property, made taxable by the laws of the state of Missouri, which I owned or which I had under my charge or management on the first

day of January. I further solemnly swear, or affirm, that I have not sent or taken, or caused to be sent or taken, any property out of this state to avoid taxation.

So help me God.

Signed _______________________________________________________ Date___________________

I have listed additional property on sheet attached.

Failure to return your Assessment List will result in a Penalty:

ASSESSED VALUE

PENALTY

ASSESSED VALUE

PENALTY

Late personal Property Lists – Sec. 137.280 RSMO states, in part, if any taxpayer neglects or refuses to deliver, by

0 – $1,000

$10

$5,001 – $6,000

$60

MARCH 1, an itemized statement or list of all the taxable tangible personal property signed and certified by the taxpayer,

$1,001 – $2,000

$20

$6,001 – $7,000

$70

the owner of the property which ought to have been listed shall be assessed a PENALTY based on the assessed value

$2,001 – $3,000

$30

$7,001 – $8,000

$80

of the property that was not reported as follows:

$3,001 – $4,000

$40

$8,001 – $9,000

$90

$4,001 – $5,000

$50

$9,001 and above

$100

SECTION 137.285 PROVIDES FOR DOUBLING OF YOUR ASSESSMENT IF YOU FILE A FRAUDULENT LIST.

104B

STON2-102 (Rev 10/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2