Form St-90 - Application For Manufacturers Or Processors Sales Tax Exemption Certificate Number

ADVERTISEMENT

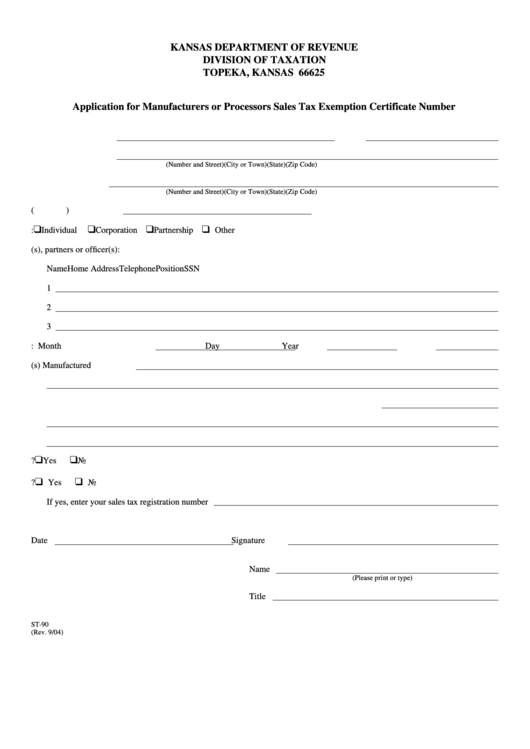

KANSAS DEPARTMENT OF REVENUE

DIVISION OF TAXATION

TOPEKA, KANSAS 66625

Application for Manufacturers or Processors Sales Tax Exemption Certificate Number

1.

Name of Business

FEIN

2.

Business Location

(Number and Street)

(City or Town)

(State)

(Zip Code)

3.

Mailing Address

(Number and Street)

(City or Town)

(State)

(Zip Code)

4.

Telephone Number (

)

❑

❑

❑

❑

5.

Type of Ownership:

Individual

Corporation

Partnership

Other

6.

List all owner(s), partners or officer(s):

Name

Home Address

Telephone

Position

SSN

1

2

3

7.

Date business started: Month

Day

Year

8.

Product(s) Manufactured

9.

Items to be purchased that will become an ingredient or component part of the finished product

❑

❑

10. Are all of your sales for resale?

Yes

No

❑

❑

11. Do you make sales to the ultimate user or consumer?

Yes

No

If yes, enter your sales tax registration number

Date

Signature

Name

(Please print or type)

Title

ST-90

(Rev. 9/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1