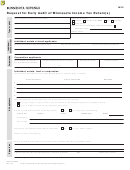

REQUEST FOR LOCAL SALES AND OPTION USE TAX INFORMATION

Sections 32.057 and 144.121, RSMo, allow the Missouri Department of Revenue to release sales and local option use tax

information to political subdivisions that have imposed a sales and/or local option use tax. It is important to note that this tax

information is confidential and may only be used according to the provisions of Section 32.057, RSMo.

To receive this tax information, the chief executive of your political subdivision (mayor or presiding commissioner) must approve

and sign the Missouri Department of Revenue Form 4379. This form must be fully completed before it will be processed. If this

form is not properly completed, we will return it for the additional information.

The request for tax information (Form 4379) is valid for one year. The department will automatically process the request in

the report frequency and in the CD format choice indicated on the form. The department will no longer provide the Sales Tax and

Local Option Use Tax Financial Distribution Report, the Open Business/Location Report and any special request reports in

printed format. For contact purposes, indicate an authorized person and telephone number. The requested information will be

sent directly to the authorized personnel as indicated on the form.

*Each political subdivision may receive one annual report (current fiscal year available) free of charge. This report reflects

information from the current July to June period and consists of two parts. One part lists the businesses registered, the business

address, the business Tax I.D. number, Standard Industry Code and business location(s). The other part is a detailed financial

report from these businesses. The cost for all other distribution reports, including monthly reports, is determined by the

Department of Revenue, Information Technology (IT). The department will contact you regarding the cost of special requests.

Please return the completed form to the Missouri Department of Revenue, Taxation Division, P.O. Box 3380, Jefferson

City, Missouri 65105-3380. The Department of Revenue can also assist you in other matters relating to the collection and

administration of your sales and local option use tax. If you have questions regarding your request or if we may be of other

assistance, please contact the Taxation Division at the above address or call (573) 751-4876 or by fax at (573)522-1160.

For more information about the types of reports available or for the cost of these reports, contact the Information Technology

Services

Division,

P.O.

Box

41,

Jefferson

City,

Missouri

65105-0041

or

call

(573)

751-4391.

1

1 2

2