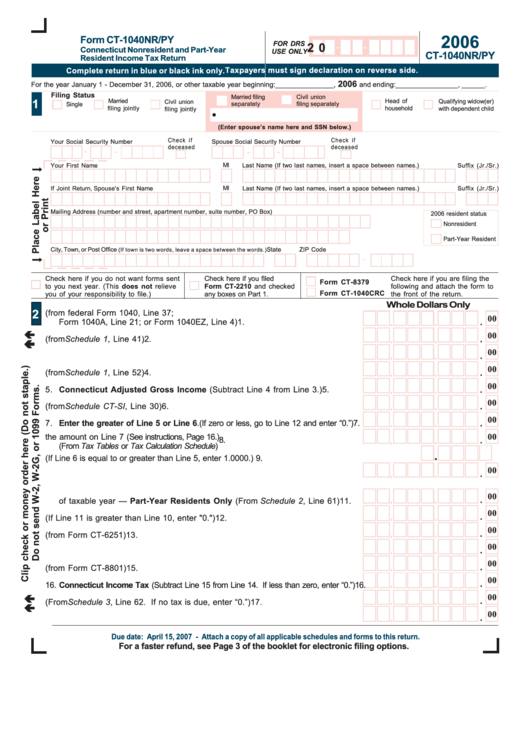

Form Ct-1040nr/py - Connecticut Nonresident And Part-Year Resident Income Tax Return - 2006

ADVERTISEMENT

2006

Form CT-1040NR/PY

FOR DRS

2 0

Connecticut Nonresident and Part-Year

USE ONLY

CT-1040NR/PY

Resident Income Tax Return

Taxpayers must sign declaration on reverse side.

Complete return in blue or black ink only.

2006

For the year January 1 - December 31, 2006, or other taxable year beginning: _______________ ,

and ending: ________________ , ______ .

Filing Status

Married filing

Civil union

1

Married

Head of

Qualifying widow(er)

Civil union

separately

filing separately

Single

filing jointly

household

with dependent child

filing jointly

(Enter spouse’s name here and SSN below.)

Check if

Check if

Your Social Security Number

Spouse Social Security Number

deceased

deceased

-

-

-

-

MI

Your First Name

Last Name (If two last names, insert a space between names.)

Suffix (Jr./Sr.)

If Joint Return, Spouse's First Name

MI

Last Name (If two last names, insert a space between names.)

Suffix (Jr./Sr.)

Mailing Address (number and street, apartment number, suite number, PO Box)

2006 resident status

Nonresident

Part-Year Resident

City, Town, or Post Office

State

ZIP Code

(If town is two words, leave a space between the words.)

-

Check here if you do not want forms sent

Check here if you filed

Check here if you are filing the

Form CT-8379

to you next year. (This does not relieve

Form CT-2210 and checked

following and attach the form to

Form CT-1040CRC

you of your responsibility to file.)

any boxes on Part 1.

the front of the return.

Whole Dollars Only

2

1. Federal adjusted gross income (from federal Form 1040, Line 37;

00

.

,

,

Form 1040A, Line 21; or Form 1040EZ, Line 4)

1.

00

.

,

,

2. Additions to federal adjusted gross income (from Schedule 1, Line 41)

2.

00

.

,

,

3. Add Line 1 and Line 2.

3.

00

.

,

,

4. Subtractions from federal adjusted gross income (from Schedule 1, Line 52)

4.

00

.

,

,

5. Connecticut Adjusted Gross Income (Subtract Line 4 from Line 3.)

5.

00

.

,

,

6. Income from Connecticut sources (from Schedule CT-SI, Line 30)

6.

00

.

,

,

7. Enter the greater of Line 5 or Line 6. (If zero or less, go to Line 12 and enter “0.”) 7.

00

8. Income tax on the amount on Line 7 (See instructions, Page 16.)

.

,

,

8.

(From Tax Tables or Tax Calculation Schedule)

.

9. Divide Line 6 by Line 5. (If Line 6 is equal to or greater than Line 5, enter 1.0000.) 9.

00

.

,

,

10. Multiply Line 9 by Line 8.

10.

11. Credit for income taxes paid to qualifying jurisdictions during resident portion

00

.

,

,

of taxable year — Part-Year Residents Only (From Schedule 2, Line 61)

11.

00

.

,

,

12. Subtract Line 11 from Line 10. (If Line 11 is greater than Line 10, enter "0.") 12.

00

.

,

,

13. Connecticut Alternative Minimum Tax (from Form CT-6251)

13.

00

.

,

,

14. Add Line 12 and Line 13.

14.

00

.

,

,

15. Adjusted Net Connecticut Minimum Tax Credit (from Form CT-8801)

15.

00

.

,

,

16. Connecticut Income Tax (Subtract Line 15 from Line 14. If less than zero, enter “0.”)16.

00

.

,

,

17. Individual Use Tax (From Schedule 3, Line 62. If no tax is due, enter “0.”)

17.

00

.

,

,

18. Add Line 16 and Line 17.

18.

Due date: April 15, 2007 - Attach a copy of all applicable schedules and forms to this return.

For a faster refund, see Page 3 of the booklet for electronic filing options.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4