Form Eq-1 - Employer'S Quarterly Return Of License Fee Withheld - City Of Richmond

ADVERTISEMENT

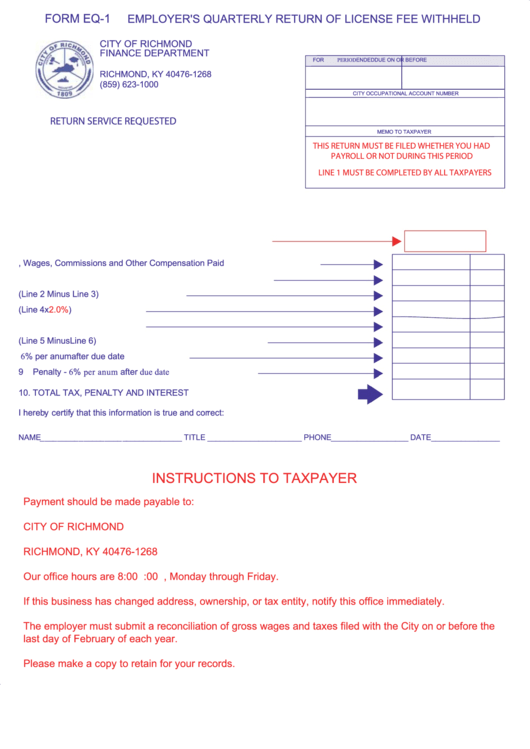

FORM EQ-1

EMPLOYER'S QUARTERLY RETURN OF LICENSE FEE WITHHELD

CITY OF RICHMOND

FINANCE DEPARTMENT

FOR

PERIOD

ENDED

DUE ON OR BEFORE

P.O. BOX 1268

RICHMOND, KY 40476-1268

(859) 623-1000

CITY OCCUPATIONAL ACCOUNT NUMBER

RETURN SERVICE REQUESTED

MEMO TO TAXPAYER

THIS RETURN MUST BE FILED WHETHER YOU HAD

PAYROLL OR NOT DURING THIS PERIOD

LINE 1 MUST BE COMPLETED BY ALL TAXPAYERS

1. Number Of Paid Individuals In Last City of Richmond Payroll

2. Total Gross Salaries, Wages, Commissions and Other Compensation Paid

3. Less Compensation Paid For Services Outside City of Richmond

4. Taxable Earnings (Line 2 Minus Line 3)

5. City Tax Due (Line 4 x 2.0%)

6. Less Credits or Prepayments

7. Net Taxes Due On or Before Due Date (Line 5 Minus Line 6)

8. Interest - 6% per anum after due date

9

Penalty - 6% per anum after due date

10. TOTAL TAX, PENALTY AND INTEREST

I hereby certify that this information is true and correct:

NAME_________________________________ TITLE ______________________ PHONE__________________ DATE________________

INSTRUCTIONS TO TAXPAYER

Payment should be made payable to:

CITY OF RICHMOND

P.O. BOX 1268

RICHMOND, KY 40476-1268

Our office hours are 8:00 a.m. to 4:00 p.m., Monday through Friday.

If this business has changed address, ownership, or tax entity, notify this office immediately.

The employer must submit a reconciliation of gross wages and taxes filed with the City on or before the

last day of February of each year.

Please make a copy to retain for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1