Form As-29-4 I - Breakdown Of Personal Property Valuation By Municipalities

ADVERTISEMENT

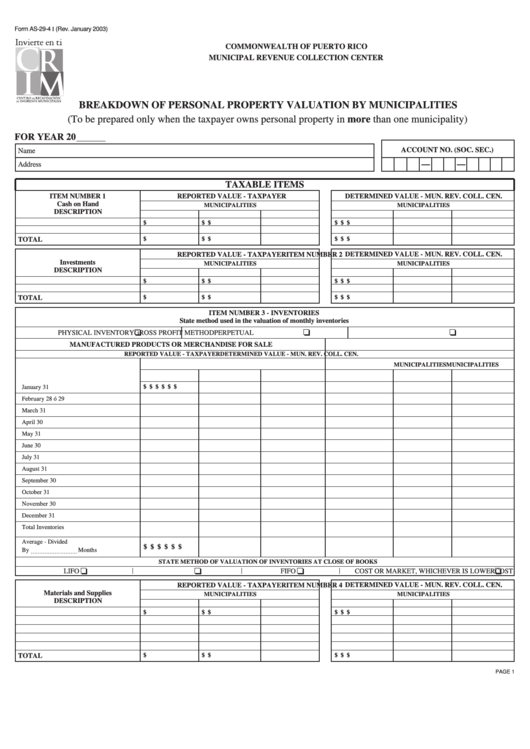

Form AS-29-4 I (Rev. January 2003)

COMMONWEALTH OF PUERTO RICO

MUNICIPAL REVENUE COLLECTION CENTER

BREAKDOWN OF PERSONAL PROPERTY VALUATION BY MUNICIPALITIES

(To be prepared only when the taxpayer owns personal property in more than one municipality)

FOR YEAR 20

ACCOUNT NO. (SOC. SEC.)

Name

Address

TAXABLE ITEMS

ITEM NUMBER 1

REPORTED VALUE - TAXPAYER

DETERMINED VALUE - MUN. REV. COLL. CEN.

Cash on Hand

MUNICIPALITIES

MUNICIPALITIES

DESCRIPTION

$

$

$

$

$

$

TOTAL

$

$

$

$

$

$

ITEM NUMBER 2

REPORTED VALUE - TAXPAYER

DETERMINED VALUE - MUN. REV. COLL. CEN.

Investments

MUNICIPALITIES

MUNICIPALITIES

DESCRIPTION

$

$

$

$

$

$

TOTAL

$

$

$

$

$

$

ITEM NUMBER 3 - INVENTORIES

State method used in the valuation of monthly inventories

PHYSICAL INVENTORY

GROSS PROFIT METHOD

PERPETUAL

MANUFACTURED PRODUCTS OR MERCHANDISE FOR SALE

REPORTED VALUE - TAXPAYER

DETERMINED VALUE - MUN. REV. COLL. CEN.

MUNICIPALITIES

MUNICIPALITIES

$

$

$

$

$

$

January 31

February 28 ó 29

March 31

April 30

May 31

June 30

July 31

August 31

September 30

October 31

November 30

December 31

Total Inventories

Average - Divided

$

$

$

$

$

$

By

Months

STATE METHOD OF VALUATION OF INVENTORIES AT CLOSE OF BOOKS

LIFO

COST

FIFO

COST OR MARKET, WHICHEVER IS LOWER

ITEM NUMBER 4

REPORTED VALUE - TAXPAYER

DETERMINED VALUE - MUN. REV. COLL. CEN.

Materials and Supplies

MUNICIPALITIES

MUNICIPALITIES

DESCRIPTION

$

$

$

$

$

$

TOTAL

$

$

$

$

$

$

PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1