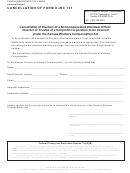

Summary Of Financial Activities Of A Charitable Organization Filing A 990/990ez - 2014 Page 3

ADVERTISEMENT

Division of Charitable Solicitations and Gaming

Office of Tennessee Secretary of State Tre Hargett

312 Rosa L. Parks Avenue, 8th Floor

Nashville, Tennessee 37243

615-741-2555

Summary of Financial Activities of a Charitable Organization

Filing a 990EZ

WARNING: False or misleading statements subject to maximum $5,000 civil penalty. T.C.A. § 48-101-514

Instructions: Complete this two page form with financial information from the most recently

completed accounting year. The form must be signed by two authorized officers, one of whom shall be

the Chief Fiscal Officer. A 990 or 990EZ form must be attached.

Name of the organization:

COID:

FEIN:

Accounting period end date:

(mm/dd/yy)

Has the accounting period changed since your last registration?

Yes No

1. Gross Revenue

Public Contributions +

A. Public Contributions [Line 1]. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

Government Grants = Line 1 On 990EZ

B. Government Grants [Line 1] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

C. Program Service Revenue [Line 2] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

D. Special Events and Activities [Line 6B] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

E. Gross Sales of Inventory [Line 7A] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

F. Other Revenue [Lines 3+4+5C+6A+8] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

G. Total Revenue [Add Lines 1A Through Line 1F] . . . . . . . . . . . . . . . . . . . . . . . .$

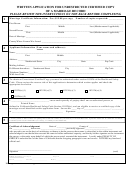

2. Expenses

Some organizations may be able to categorize expenses based on the lines provided below. Please

itemize if possible. Please note that Total Expenses are on page 1 of the 990-EZ (Part I, Line 17), while

Program Service Expenses are on the next page (Part III, Line 32) – be sure to subtract Program Service

Expenses from Total Expenses before reporting on the Summary of Financial Activities. If you can

determine the amount that your organization spent on fundraising during the reporting period, simply

subtract Program Service Expenses and Fundraising Expenses from your Total Expenses to determine

the figure to enter on the Summary of Financial Activities form for Management and General Expenses.

Remember, Program Expenses + Management/General Expenses + Fundraising Expenses + Other

Expenses = Total Expenses.

3. Changes in Net Assets or Fund balances

A. Net assets / fund balances at beginning of year [Line 19] . . . . . . . . . . . . . . . .$

B. Other changes in net assets or fund balances [Line 20] . . . . . . . . . . . . . . . . . .$

C. Net assets / fund balances [Line 21] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

D. Total Assets [Line 25]. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

E. Total Liabilities [Line 26] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

F. Net assets / fund balances [Line 27]. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

4. Accounting method used: Cash Accrual Other

SS-6002 (Rev. 08/14), RDA 2994

Page: 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4