Form Mft-504 - West Virginia Motor Fuel Supplier/permissive Supplier

ADVERTISEMENT

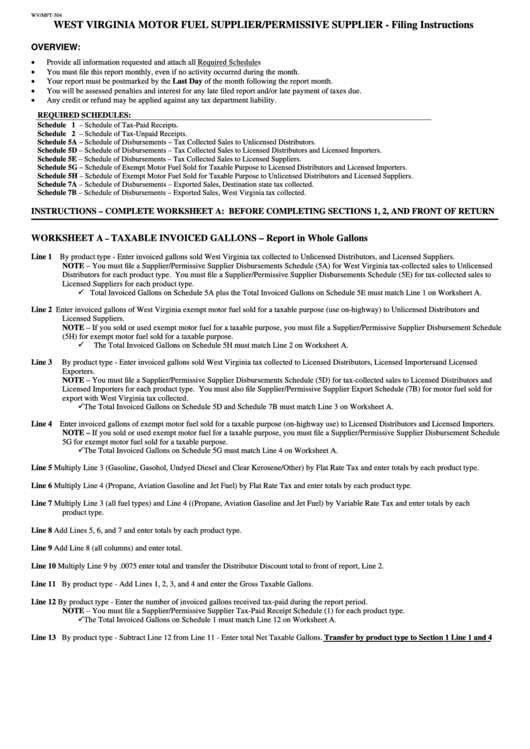

WV/MFT-504

WEST VIRGINIA MOTOR FUEL SUPPLIER/PERMISSIVE SUPPLIER - Filing Instructions

OVERVIEW:

•

Provide all information requested and attach all Required Schedules

•

You must file this report monthly, even if no activity occurred during the month.

•

Your report must be postmarked by the Last Day of the month following the report month.

•

You will be assessed penalties and interest for any late filed report and/or late payment of taxes due.

•

Any credit or refund may be applied against any tax department liability.

REQUIRED SCHEDULES:

Schedule 1 – Schedule of Tax-Paid Receipts.

Schedule 2 – Schedule of Tax-Unpaid Receipts.

Schedule 5A – Schedule of Disbursements – Tax Collected Sales to Unlicensed Distributors.

Schedule 5D – Schedule of Disbursements – Tax Collected Sales to Licensed Distributors and Licensed Importers.

Schedule 5E – Schedule of Disbursements – Tax Collected Sales to Licensed Suppliers.

Schedule 5G – Schedule of Exempt Motor Fuel Sold for Taxable Purpose to Licensed Distributors and Licensed Importers.

Schedule 5H – Schedule of Exempt Motor Fuel Sold for Taxable Purpose to Unlicensed Distributors and Licensed Suppliers.

Schedule 7A – Schedule of Disbursements – Exported Sales, Destination state tax collected.

Schedule 7B – Schedule of Disbursements – Exported Sales, West Virginia tax collected.

INSTRUCTIONS – COMPLETE WORKSHEET A: BEFORE COMPLETING SECTIONS 1, 2, AND FRONT OF RETURN

WORKSHEET A

TAXABLE INVOICED GALLONS – Report in Whole Gallons

–

Line 1

By product type - Enter invoiced gallons sold West Virginia tax collected to Unlicensed Distributors, and Licensed Suppliers.

NOTE – You must file a Supplier/Permissive Supplier Disbursements Schedule (5A) for West Virginia tax-collected sales to Unlicensed

Distributors for each product type. You must file a Supplier/Permissive Supplier Disbursements Schedule (5E) for tax-collected sales to

Licensed Suppliers for each product type.

Total Invoiced Gallons on Schedule 5A plus the Total Invoiced Gallons on Schedule 5E must match Line 1 on Worksheet A.

Line 2

Enter invoiced gallons of West Virginia exempt motor fuel sold for a taxable purpose (use on-highway) to Unlicensed Distributors and

Licensed Suppliers.

NOTE – If you sold or used exempt motor fuel for a taxable purpose, you must file a Supplier/Permissive Supplier Disbursement Schedule

(5H) for exempt motor fuel sold for a taxable purpose.

The Total Invoiced Gallons on Schedule 5H must match Line 2 on Worksheet A.

Line 3

By product type - Enter invoiced gallons sold West Virginia tax collected to Licensed Distributors, Licensed Importers and Licensed

Exporters.

NOTE – You must file a Supplier/Permissive Supplier Disbursements Schedule (5D) for tax-collected sales to Licensed Distributors and

Licensed Importers for each product type. You must also file Supplier/Permissive Supplier Export Schedule (7B) for motor fuel sold for

export with West Virginia tax collected.

The Total Invoiced Gallons on Schedule 5D and Schedule 7B must match Line 3 on Worksheet A.

Line 4

Enter invoiced gallons of exempt motor fuel sold for a taxable purpose (on-highway use) to Licensed Distributors and Licensed Importers.

NOTE – If you sold or used exempt motor fuel for a taxable purpose, you must file a Supplier/Permissive Supplier Disbursement Schedule

5G for exempt motor fuel sold for a taxable purpose.

The Total Invoiced Gallons on Schedule 5G must match Line 4 on Worksheet A.

Line 5

Multiply Line 3 (Gasoline, Gasohol, Undyed Diesel and Clear Kerosene/Other) by Flat Rate Tax and enter totals by each product type.

Line 6

Multiply Line 4 (Propane, Aviation Gasoline and Jet Fuel) by Flat Rate Tax and enter totals by each product type.

Line 7

Multiply Line 3 (all fuel types) and Line 4 ((Propane, Aviation Gasoline and Jet Fuel) by Variable Rate Tax and enter totals by each

product type.

Line 8

Add Lines 5, 6, and 7 and enter totals by each product type.

Line 9

Add Line 8 (all columns) and enter total.

Line 10 Multiply Line 9 by .0075 enter total and transfer the Distributor Discount total to front of report, Line 2.

Line 11 By product type - Add Lines 1, 2, 3, and 4 and enter the Gross Taxable Gallons.

Line 12 By product type - Enter the number of invoiced gallons received tax-paid during the report period.

NOTE – You must file a Supplier/Permissive Supplier Tax-Paid Receipt Schedule (1) for each product type.

The Total Invoiced Gallons on Schedule 1 must match Line 12 on Worksheet A.

Line 13 By product type - Subtract Line 12 from Line 11 - Enter total Net Taxable Gallons. Transfer by product type to Section 1 Line 1 and 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3