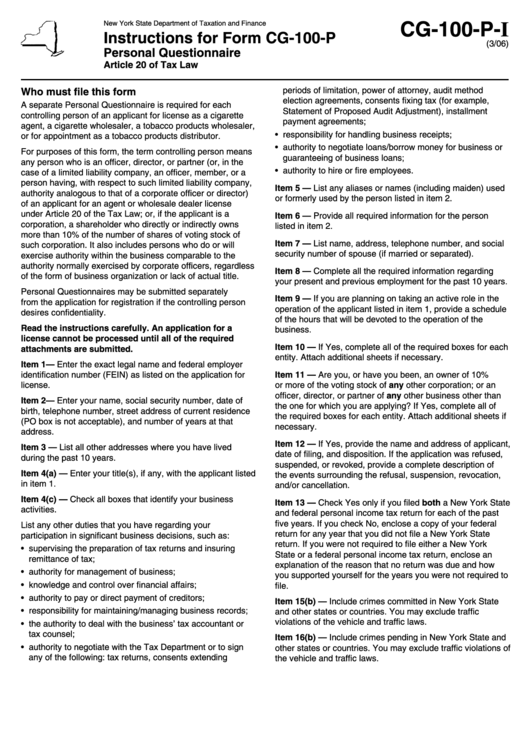

Instructions For Form Cg-100-P - Personal Questionnaire 2006

ADVERTISEMENT

CG-100-P-I

New York State Department of Taxation and Finance

Instructions for Form CG-100-P

(3/06)

Personal Questionnaire

Article 20 of Tax Law

Who must file this form

periods of limitation, power of attorney, audit method

election agreements, consents fixing tax (for example,

A separate Personal Questionnaire is required for each

Statement of Proposed Audit Adjustment), installment

controlling person of an applicant for license as a cigarette

payment agreements;

agent, a cigarette wholesaler, a tobacco products wholesaler,

• responsibility for handling business receipts;

or for appointment as a tobacco products distributor.

• authority to negotiate loans/borrow money for business or

For purposes of this form, the term controlling person means

guaranteeing of business loans;

any person who is an officer, director, or partner (or, in the

• authority to hire or fire employees.

case of a limited liability company, an officer, member, or a

person having, with respect to such limited liability company,

Item 5 — List any aliases or names (including maiden) used

authority analogous to that of a corporate officer or director)

or formerly used by the person listed in item 2.

of an applicant for an agent or wholesale dealer license

under Article 20 of the Tax Law; or, if the applicant is a

Item 6 — Provide all required information for the person

corporation, a shareholder who directly or indirectly owns

listed in item 2.

more than 10% of the number of shares of voting stock of

Item 7 — List name, address, telephone number, and social

such corporation. It also includes persons who do or will

security number of spouse (if married or separated).

exercise authority within the business comparable to the

authority normally exercised by corporate officers, regardless

Item 8 — Complete all the required information regarding

of the form of business organization or lack of actual title.

your present and previous employment for the past 10 years.

Personal Questionnaires may be submitted separately

Item 9 — If you are planning on taking an active role in the

from the application for registration if the controlling person

operation of the applicant listed in item 1, provide a schedule

desires confidentiality.

of the hours that will be devoted to the operation of the

Read the instructions carefully. An application for a

business.

license cannot be processed until all of the required

Item 10 — If Yes, complete all of the required boxes for each

attachments are submitted.

entity. Attach additional sheets if necessary.

Item 1 — Enter the exact legal name and federal employer

Item 11 — Are you, or have you been, an owner of 10%

identification number (FEIN) as listed on the application for

or more of the voting stock of any other corporation; or an

license.

officer, director, or partner of any other business other than

Item 2 — Enter your name, social security number, date of

the one for which you are applying? If Yes, complete all of

birth, telephone number, street address of current residence

the required boxes for each entity. Attach additional sheets if

(PO box is not acceptable), and number of years at that

necessary.

address.

Item 12 — If Yes, provide the name and address of applicant,

Item 3 — List all other addresses where you have lived

date of filing, and disposition. If the application was refused,

during the past 10 years.

suspended, or revoked, provide a complete description of

Item 4(a) — Enter your title(s), if any, with the applicant listed

the events surrounding the refusal, suspension, revocation,

in item 1.

and/or cancellation.

Item 4(c) — Check all boxes that identify your business

Item 13 — Check Yes only if you filed both a New York State

activities.

and federal personal income tax return for each of the past

five years. If you check No, enclose a copy of your federal

List any other duties that you have regarding your

return for any year that you did not file a New York State

participation in significant business decisions, such as:

return. If you were not required to file either a New York

• supervising the preparation of tax returns and insuring

State or a federal personal income tax return, enclose an

remittance of tax;

explanation of the reason that no return was due and how

• authority for management of business;

you supported yourself for the years you were not required to

• knowledge and control over financial affairs;

file.

• authority to pay or direct payment of creditors;

Item 15(b) — Include crimes committed in New York State

• responsibility for maintaining/managing business records;

and other states or countries. You may exclude traffic

violations of the vehicle and traffic laws.

• the authority to deal with the business’ tax accountant or

tax counsel;

Item 16(b) — Include crimes pending in New York State and

• authority to negotiate with the Tax Department or to sign

other states or countries. You may exclude traffic violations of

any of the following: tax returns, consents extending

the vehicle and traffic laws.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2