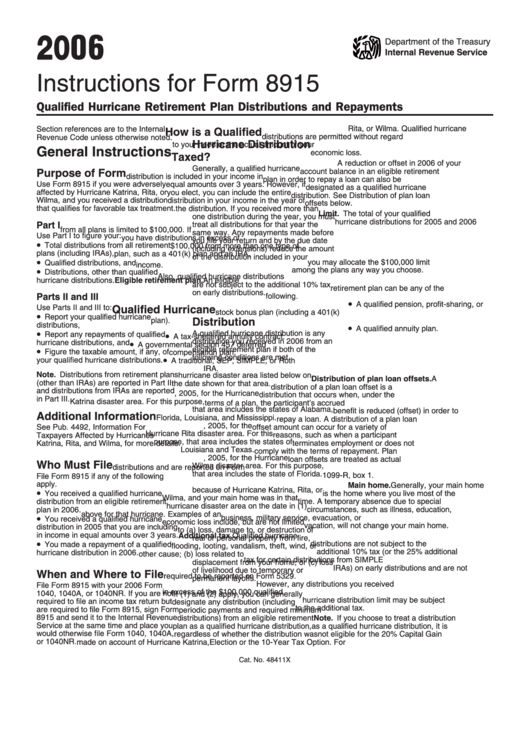

Instructions For Form 8915 - 2006

ADVERTISEMENT

2006

Department of the Treasury

Internal Revenue Service

Instructions for Form 8915

Qualified Hurricane Retirement Plan Distributions and Repayments

Rita, or Wilma. Qualified hurricane

Section references are to the Internal

How is a Qualified

distributions are permitted without regard

Revenue Code unless otherwise noted.

Hurricane Distribution

to your need or the actual amount of your

General Instructions

economic loss.

Taxed?

A reduction or offset in 2006 of your

Generally, a qualified hurricane

account balance in an eligible retirement

Purpose of Form

distribution is included in your income in

plan in order to repay a loan can also be

Use Form 8915 if you were adversely

equal amounts over 3 years. However, if

designated as a qualified hurricane

affected by Hurricane Katrina, Rita, or

you elect, you can include the entire

distribution. See Distribution of plan loan

Wilma, and you received a distribution

distribution in your income in the year of

offsets below.

that qualifies for favorable tax treatment.

the distribution. If you received more than

Limit. The total of your qualified

one distribution during the year, you must

hurricane distributions for 2005 and 2006

Part I

treat all distributions for that year the

from all plans is limited to $100,000. If

same way. Any repayments made before

Use Part I to figure your:

you have distributions in excess of

you file your return and by the due date

•

Total distributions from all retirement

$100,000 from more than one type of

(including extensions) reduce the amount

plans (including IRAs),

plan, such as a 401(k) plan and an IRA,

of the distribution included in your

•

you may allocate the $100,000 limit

Qualified distributions, and

income.

•

among the plans any way you choose.

Distributions, other than qualified

Also, qualified hurricane distributions

hurricane distributions.

Eligible retirement plan. An eligible

are not subject to the additional 10% tax

retirement plan can be any of the

on early distributions.

Parts II and III

following.

•

A qualified pension, profit-sharing, or

Use Parts II and III to:

Qualified Hurricane

stock bonus plan (including a 401(k)

•

Report your qualified hurricane

plan).

Distribution

distributions,

•

A qualified annuity plan.

•

•

A qualified hurricane distribution is any

Report any repayments of qualified

A tax-sheltered annuity contract.

distribution you received in 2006 from an

•

hurricane distributions, and

A governmental section 457 deferred

•

eligible retirement plan if both of the

Figure the taxable amount, if any, of

compensation plan.

•

following conditions are met.

your qualified hurricane distributions.

A traditional, SEP, SIMPLE, or Roth

1. Your main home was located in a

IRA.

Note. Distributions from retirement plans

hurricane disaster area listed below on

Distribution of plan loan offsets. A

(other than IRAs) are reported in Part II

the date shown for that area.

distribution of a plan loan offset is a

and distributions from IRAs are reported

a. August 28, 2005, for the Hurricane

distribution that occurs when, under the

in Part III.

Katrina disaster area. For this purpose,

terms of a plan, the participant’s accrued

that area includes the states of Alabama,

benefit is reduced (offset) in order to

Additional Information

Florida, Louisiana, and Mississippi.

repay a loan. A distribution of a plan loan

b. September 23, 2005, for the

See Pub. 4492, Information For

offset amount can occur for a variety of

Hurricane Rita disaster area. For this

Taxpayers Affected by Hurricanes

reasons, such as when a participant

purpose, that area includes the states of

terminates employment or does not

Katrina, Rita, and Wilma, for more details.

Louisiana and Texas.

comply with the terms of repayment. Plan

c. October 23, 2005, for the Hurricane

loan offsets are treated as actual

Who Must File

Wilma disaster area. For this purpose,

distributions and are reported on Form

that area includes the state of Florida.

1099-R, box 1.

File Form 8915 if any of the following

2. You sustained an economic loss

apply.

Main home. Generally, your main home

•

because of Hurricane Katrina, Rita, or

is the home where you live most of the

You received a qualified hurricane

Wilma, and your main home was in that

distribution from an eligible retirement

time. A temporary absence due to special

hurricane disaster area on the date in (1)

plan in 2006.

circumstances, such as illness, education,

above for that hurricane. Examples of an

•

business, military service, evacuation, or

You received a qualified hurricane

economic loss include, but are not limited

vacation, will not change your main home.

distribution in 2005 that you are including

to (a) loss, damage to, or destruction of

in income in equal amounts over 3 years.

Additional tax. Qualified hurricane

real or personal property from fire,

•

distributions are not subject to the

You made a repayment of a qualified

flooding, looting, vandalism, theft, wind, or

additional 10% tax (or the 25% additional

hurricane distribution in 2006.

other cause; (b) loss related to

tax for certain distributions from SIMPLE

displacement from your home; or (c) loss

IRAs) on early distributions and are not

of livelihood due to temporary or

When and Where to File

required to be reported on Form 5329.

permanent layoffs.

However, any distributions you received

File Form 8915 with your 2006 Form

in excess of the $100,000 qualified

1040, 1040A, or 1040NR. If you are not

If (1) and (2) apply, you can generally

hurricane distribution limit may be subject

required to file an income tax return but

designate any distribution (including

to the additional tax.

are required to file Form 8915, sign Form

periodic payments and required minimum

8915 and send it to the Internal Revenue

distributions) from an eligible retirement

Note. If you choose to treat a distribution

Service at the same time and place you

plan as a qualified hurricane distribution,

as a qualified hurricane distribution, it is

would otherwise file Form 1040, 1040A,

regardless of whether the distribution was

not eligible for the 20% Capital Gain

or 1040NR.

made on account of Hurricane Katrina,

Election or the 10-Year Tax Option. For

Cat. No. 48411X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3