Instructions For Rittman City Income Tax Form - 2012

ADVERTISEMENT

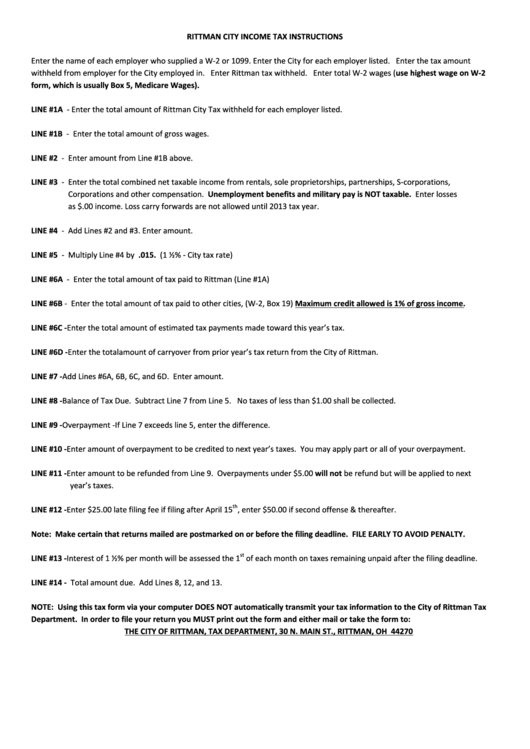

RITTMAN CITY INCOME TAX INSTRUCTIONS

Enter the name of each employer who supplied a W-2 or 1099. Enter the City for each employer listed. Enter the tax amount

withheld from employer for the City employed in. Enter Rittman tax withheld. Enter total W-2 wages (use highest wage on W-2

form, which is usually Box 5, Medicare Wages).

LINE #1A - Enter the total amount of Rittman City Tax withheld for each employer listed.

LINE #1B - Enter the total amount of gross wages.

LINE #2 - Enter amount from Line #1B above.

LINE #3 - Enter the total combined net taxable income from rentals, sole proprietorships, partnerships, S-corporations,

Corporations and other compensation. Unemployment benefits and military pay is NOT taxable. Enter losses

as $.00 income. Loss carry forwards are not allowed until 2013 tax year.

LINE #4 - Add Lines #2 and #3. Enter amount.

LINE #5 - Multiply Line #4 by .015. (1 ½% - City tax rate)

LINE #6A - Enter the total amount of tax paid to Rittman (Line #1A)

LINE #6B - Enter the total amount of tax paid to other cities, (W-2, Box 19) Maximum credit allowed is 1% of gross income.

LINE #6C - Enter the total amount of estimated tax payments made toward this year’s tax.

LINE #6D - Enter the total amount of carryover from prior year’s tax return from the City of Rittman.

LINE #7 - Add Lines #6A, 6B, 6C, and 6D. Enter amount.

LINE #8 - Balance of Tax Due. Subtract Line 7 from Line 5. No taxes of less than $1.00 shall be collected.

LINE #9 - Overpayment - If Line 7 exceeds line 5, enter the difference.

LINE #10 - Enter amount of overpayment to be credited to next year’s taxes. You may apply part or all of your overpayment.

LINE #11 - Enter amount to be refunded from Line 9. Overpayments under $5.00 will not be refund but will be applied to next

year’s taxes.

th

LINE #12 - Enter $25.00 late filing fee if filing after April 15

, enter $50.00 if second offense & thereafter.

Note: Make certain that returns mailed are postmarked on or before the filing deadline. FILE EARLY TO AVOID PENALTY.

st

LINE #13 - Interest of 1 ½% per month will be assessed the 1

of each month on taxes remaining unpaid after the filing deadline.

LINE #14 - Total amount due. Add Lines 8, 12, and 13.

NOTE: Using this tax form via your computer DOES NOT automatically transmit your tax information to the City of Rittman Tax

Department. In order to file your return you MUST print out the form and either mail or take the form to:

THE CITY OF RITTMAN, TAX DEPARTMENT, 30 N. MAIN ST., RITTMAN, OH 44270

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2