Hospitality Tax Reporting Form - Town Of Fort Mill

ADVERTISEMENT

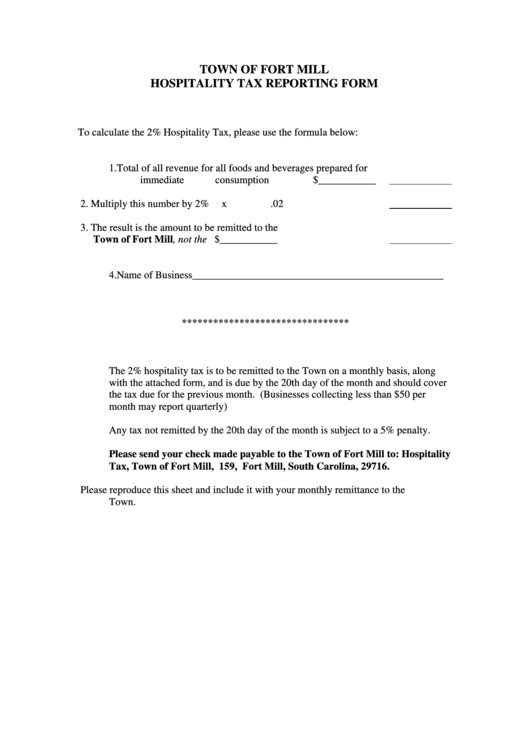

TOWN OF FORT MILL

HOSPITALITY TAX REPORTING FORM

To calculate the 2% Hospitality Tax, please use the formula below:

1. Total of all revenue for all foods and beverages prepared for

immediate consumption

$___________

2. Multiply this number by 2%

x

.02

3. The result is the amount to be remitted to the

Town of Fort Mill, not the S.C. Department of Revenue

$___________

4. Name of Business________________________________________________

********************************

The 2% hospitality tax is to be remitted to the Town on a monthly basis, along

with the attached form, and is due by the 20th day of the month and should cover

the tax due for the previous month. (Businesses collecting less than $50 per

month may report quarterly)

Any tax not remitted by the 20th day of the month is subject to a 5% penalty.

Please send your check made payable to the Town of Fort Mill to: Hospitality

Tax, Town of Fort Mill, P.O. Box 159, Fort Mill, South Carolina, 29716.

Please reproduce this sheet and include it with your monthly remittance to the

Town.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1