Local Tax On Food And Beverage Form - Town Of Luray

ADVERTISEMENT

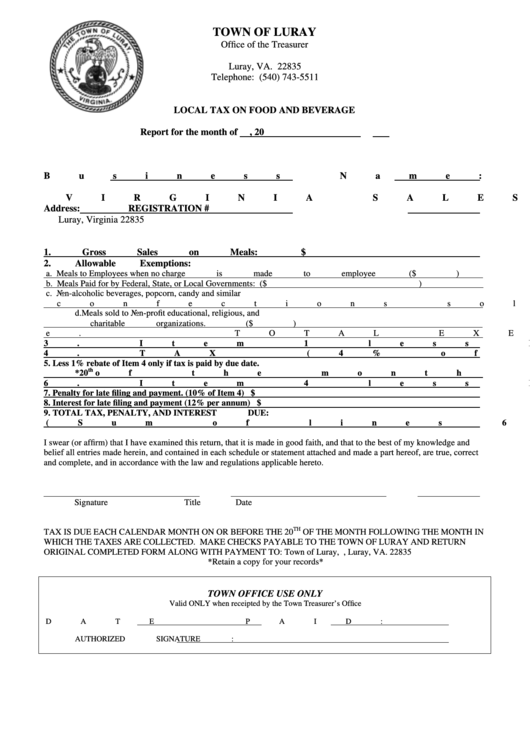

TOWN OF LURAY

Office of the Treasurer

P.O. Box 629

Luray, VA. 22835

Telephone: (540) 743-5511

LOCAL TAX ON FOOD AND BEVERAGE

Report for the month of

, 20

Business Name:

TAXPAYER ID#

VIRGINIA SALES TAX

Address:

REGISTRATION #

Luray, Virginia 22835

1.

Gross Sales on Meals:

$

2.

Allowable Exemptions:

a. Meals to Employees when no charge is made to employee

($

)

b. Meals Paid for by Federal, State, or Local Governments:

($

)

c. Non-alcoholic beverages, popcorn, candy and similar

confections sold in theaters.

($

)

d. Meals sold to Non-profit educational, religious, and

charitable organizations.

($

)

e. TOTAL EXEMPTIONS:

($

)

3.

Item 1 less Item 2 (e)

$

4.

TAX (4% of Item 3)

$

5.

Less 1% rebate of Item 4 only if tax is paid by due date.

th

*20

of the month

($

)

6.

Item 4 less Item 5

$

7.

Penalty for late filing and payment. (10% of Item 4)

$

8.

Interest for late filing and payment (12% per annum)

$

9.

TOTAL TAX, PENALTY, AND INTEREST DUE:

(Sum of lines 6, 7, and 8)

$

I swear (or affirm) that I have examined this return, that it is made in good faith, and that to the best of my knowledge and

belief all entries made herein, and contained in each schedule or statement attached and made a part hereof, are true, correct

and complete, and in accordance with the law and regulations applicable hereto.

Signature

Title

Date

TH

TAX IS DUE EACH CALENDAR MONTH ON OR BEFORE THE 20

OF THE MONTH FOLLOWING THE MONTH IN

WHICH THE TAXES ARE COLLECTED. MAKE CHECKS PAYABLE TO THE TOWN OF LURAY AND RETURN

ORIGINAL COMPLETED FORM ALONG WITH PAYMENT TO: Town of Luray, P.O. Box 629, Luray, VA. 22835

*Retain a copy for your records*

TOWN OFFICE USE ONLY

Valid ONLY when receipted by the Town Treasurer’s Office

DATE PAID:

AMOUNT:

AUTHORIZED SIGNATURE :

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1