Form Ir - Lordstown Income Tax Return - 2006

ADVERTISEMENT

z

b

L

Y

o

(D

I

r

u)

J

o

[lJ

T

O

6

ht

=

o

E

' 1 .

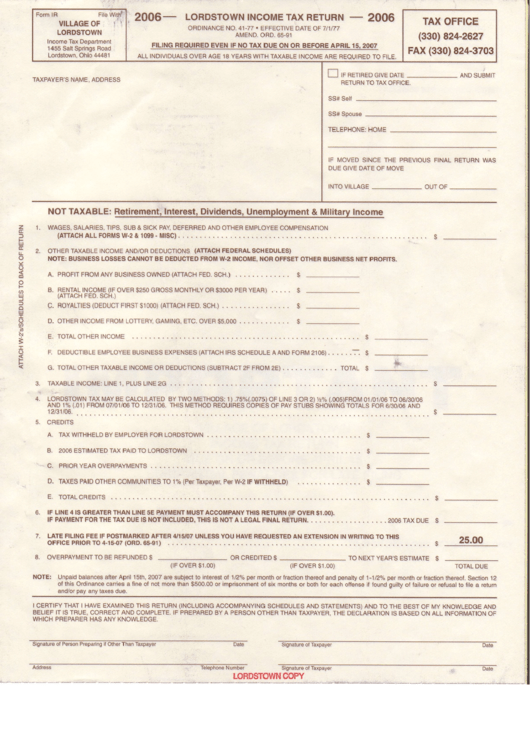

2006-

LORDSTOWN TNCOME rAx RETURN -

2006

ORDINANCE NO. 41-77 . EFFECTIVE DATE OF 7/1 177

A M E N D . O R D . 6 5 - 9 1

FILING REQUIRED EVEN IF NO TAX DUE ON OR BEFORE APRIL 15, 2OO7

ALL INDIVIDUALS OVER AGE 18 YEARS WITH TAXABLE INCOME ARE REQUIRED TO FILE.

ll

tT ntr ilhtru

ulvtr

uAttr

AND SU6M|T

TAXPAYER'S NAME. ADDRESS

RETURN TO TAX OFFICE

SS# Self

SS# Spouse

T E L E P H O N E : H O M E

IF MOVED SINCE THE PREVIOUS FINAL RETURN WAS

DUE GIVE DATE OF MOVE

INTO VILLAGE

NOT TAXABLE: Retirement,:lnterest,

Dividends, Unemployment & Military Income

WAGES, SALARIES, TIPS, SUB & SICK PAY DEFERRED AND OTHER EMPLOYEE COMPENSATION

( A T T A C H A L L F O R M S W - 2 & 1 0 9 9 - M | S C ) .

. . . . 1 . , . . $

oTHER TAXABLE INcoME AND/oR DEDUCTIoNS (ATTACI-I FEDERAL SCHEDULES)

NOTE: BUSINESS LOSSES CANNOT BE DEDUCTED FROM W.2 INCOME, NOR OFFSET OTHER tsUSINESS NET PROFITS.

A . P R O F T T F R O M A N Y B U S T N E S S O W N E D ( A T T A C H F E D . S C H . )

. . . . . . .

$

B. RENTAL TNCOME (rF OVEB $250 GROSS MONTHLY OR $3000 pER YEAR) . . . . . $

(ATTACH FED. SCH.)

c. RoYALTTES

(DEDUCT FIRST $1 000) (ATTACH FED. SCH.)

$

D. OTHER INCOME FROM LOTTERY GAMING, ETC. OVER $5,OOO .

$

E . T O T A L O T H E R I N C O M E

. . , . .

$

F. DEDUCTIBLE EMPLOYEE BUSINESS EXPENSES (ATTACH IRS SCHEDULE A AND FORM 21 06) . , . . . .

_-

$

G . T O T A L O T H E R T A X A B L E I N C O M E O R D E D U C T I O N S ( S U B T R A C T 2 F F R O M 2 E ) . . . . , . .

T O T A L $

TAXABLE INCOME: LINE 1, PLUS LINE 2G

. . . . . . $

LORDSTOWNTAXMAYBECALCULATED

BYTWOMETHODS:

1\.75L(.0075lOFL|NE3Oa2)yz%(.005)FROM01/01/06TO06/30/06

AND 1% (.01) FROM 07101/06 TO 12/31/06. THIS METHOD REQUIRES COPIES OF PAY STUBS SHOWING TOTALS FOR 6/30/06 AND

1 2 / 3 1 / 0 6 .

. . . .

$

CREDITS

A . T A X W I T H H E L D B Y E M P L O Y E R F O R L O R D S T O W N . . . .

. . . . . . . .

$

B . 2 o o 6 E S T T M A T E D T A X P A T D T O L O R D S T O W N

. . . . . . . .

. $

c . P R T o R Y E A R O V E R P A Y M E N T S .

. . . . . .

$

D . T A X E S P A I D O T H E R C O M M U N I T I E S T O l % ( P e r T a x p a y e ( , P e r W - 2 I F W I T H H E L D )

. . . . . . . . .

$

t(,

3 .

4 .

E . T O T A L C R E D I T S . . .

IF LINE 4 IS GREATER THAN LINE 5E PAYMENT MUST ACCOMPANY THIS RETURN (IF OVER $1.00).

IF PAYMENT FOR THE TAX DUE IS NOT INCLUDED, THIS IS NOT A LEGAL FINAL RETURN.

2006 TAX DUE

LATE FILING FEE IF POSTMARKED AFTER 4/15/07 UNLESS YOU HAVE REQUESTED AN EXTENSION IN WRITING TO THIS

oFFlcE PR|OR TO 4-15-07 (ORD.65-91)

25.00

$

8. OVERPAYMENTTO

BE REFUNDED

$

OR CHEDITED S

TO NEXT YEAR'S ESTIMATE

(rF ovER $1.00)

(rF ovER $1.00)

TOTAL DUE

N O T E : U n p a i d b a l a n c e s a f t e r A p r i l

l s t h , 2 0 0 T a r e s u b j e c t t o i n t e r e s t o t l l 2 o k p e r m o n t h o r f r a c t i o n t h e r e o l a n d p e n a l t y o f l - 1 / 2 o / o p e t m o n t h o r f r a c t i o n t h e r e o f . s e c t i o n l 2

of this Ordinance carries a fine of not more lhan $500.00 or imprisonment of six months or both for each oflense if found guilty of failure or refusal to file a return

and/or pay any taxes due.

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO

BELIEF IT IS TRUE, CORRECT AND COMPLETE" IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION

WHICH PREPARER HAS ANY KNOWLEDGE,

THE BEST OF MY KNOWLEDGE AND

IS BASED ON ALL INFORMATION OF

Signature oI Person Preparing if Other Than Tdpayer

Signature of Taxpayer

Address

Telephoneirlumber

.

Date

LORDSTOWN

COPY

Form lR

File

V I L L A G E O F

l : l

LORDSTOWN

Income Tax Deoartment

1455 Salt Springs Road

Lordstown. Ohio 44481

TAX OFFICE

(330) 824-2627

FAX (330) 824-3703

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1