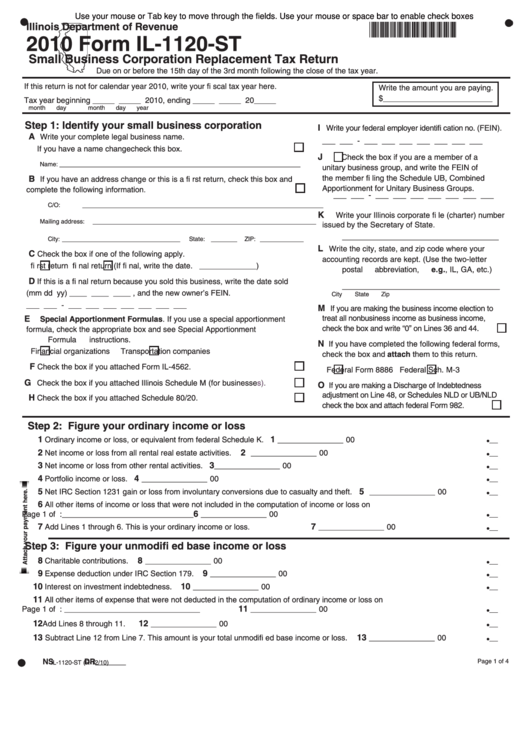

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

*032701110*

Illinois Department of Revenue

2010 Form IL-1120-ST

Small Business Corporation Replacement Tax Return

Due on or before the 15th day of the 3rd month following the close of the tax year.

If this return is not for calendar year 2010, write your fi scal tax year here.

Write the amount you are paying.

$_________________________

Tax year beginning _____ _____ 2010, ending _____ _____ 20_____

month

day

month

day

year

Step 1: Identify your small business corporation

I

Write your federal employer identifi cation no. (FEIN).

A

Write your complete legal business name.

___ ___ - ___ ___ ___ ___ ___ ___ ___

If you have a name change check this box.

J

Check the box if you are a member of a

_______________________________________________________

Name:

unitary business group, and write the FEIN of

the member fi ling the Schedule UB, Combined

B

If you have an address change or this is a fi rst return, check this box and

Apportionment for Unitary Business Groups.

complete the following information.

___ ___ - ___ ___ ___ ___ ___ ___ ___

_______________________________________________________

C/O:

K

Write your Illinois corporate fi le (charter) number

___________________________________________________

Mailing address:

issued by the Secretary of State.

_________________________________

___________________________

______

__________

City:

State:

ZIP:

L

Write the city, state, and zip code where your

C

Check the box if one of the following apply.

accounting records are kept. (Use the two-letter

fi rst return

fi nal return (If fi nal, write the date. _____________)

postal abbreviation, e.g., IL, GA, etc.)

D

If this is a fi nal return because you sold this business, write the date sold

____________________________________

(mm dd yy) ____ ____ ____ , and the new owner’s FEIN.

City

State

Zip

___ ___ - ___ ___ ___ ___ ___ ___ ___

M

If you are making the business income election to

treat all nonbusiness income as business income,

E

Special Apportionment Formulas. If you use a special apportionment

check the box and write “0” on Lines 36 and 44.

formula, check the appropriate box and see Special Apportionment

Formula instructions.

N

If you have completed the following federal forms,

Financial organizations

Transportation companies

check the box and attach them to this return.

F

Check the box if you attached Form IL-4562.

Federal Form 8886

Federal Sch. M-3

G

Check the box if you attached Illinois Schedule M (for

businesses).

O

If you are making a Discharge of Indebtedness

adjustment on Line 48, or Schedules NLD or UB/NLD

H

Check the box if you attached Schedule 80/20.

check the box and attach federal Form 982.

Step 2: Figure your ordinary income or loss

1

1

Ordinary income or loss, or equivalent from federal Schedule K.

_______________ 00

2

2

Net income or loss from all rental real estate activities.

_______________ 00

3

3

Net income or loss from other rental activities.

_______________ 00

4

4

Portfolio income or loss.

_______________ 00

5

5

Net IRC Section 1231 gain or loss from involuntary conversions due to casualty and theft.

_______________ 00

6

All other items of income or loss that were not included in the computation of income or loss on

6

Page 1 of U.S. Form 1120-S. See instructions. Identify:______________________________

_______________ 00

7

7

Add Lines 1 through 6. This is your ordinary income or loss.

_______________ 00

Step 3: Figure your unmodifi ed base income or loss

8

8

Charitable contributions.

_______________ 00

9

9

Expense deduction under IRC Section 179.

_______________ 00

10

10

Interest on investment indebtedness.

_______________ 00

11

All other items of expense that were not deducted in the computation of ordinary income or loss on

11

Page 1 of U.S. Form 1120-S. See instructions. Identify: _______________________________

_______________ 00

12

12

Add Lines 8 through 11.

_______________ 00

13

13

Subtract Line 12 from Line 7. This amount is your total unmodifi ed base income or loss.

_______________ 00

NS

DR_______

Page 1 of 4

IL-1120-ST (R-12/10)

1

1 2

2 3

3