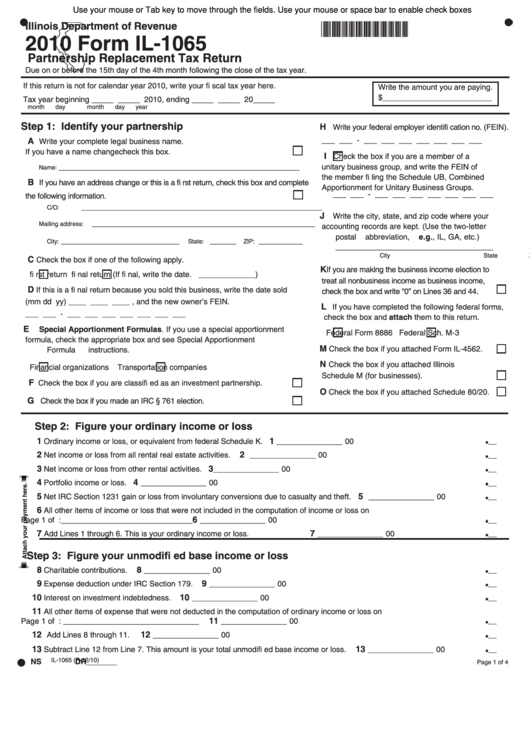

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

*032401110*

Illinois Department of Revenue

2010 Form IL-1065

Partnership Replacement Tax Return

Due on or before the 15th day of the 4th month following the close of the tax year.

If this return is not for calendar year 2010, write your fi scal tax year here.

Write the amount you are paying.

$_________________________

Tax year beginning _____ _____ 2010, ending _____ _____ 20_____

month

day

month

day

year

Step 1: Identify your partnership

H

Write your federal employer identifi cation no. (FEIN).

___ ___ - ___ ___ ___ ___ ___ ___ ___

A

Write your complete legal business name.

If you have a name change check this box.

I

Check the box if you are a member of a

_______________________________________________________

unitary business group, and write the FEIN of

Name:

the member fi ling the Schedule UB, Combined

B

If you have an address change or this is a fi rst return, check this box and complete

Apportionment for Unitary Business Groups.

the following information.

___ ___ - ___ ___ ___ ___ ___ ___ ___

_______________________________________________________

C/O:

J

Write the city, state, and zip code where your

___________________________________________________

Mailing address:

accounting records are kept. (Use the two-letter

postal abbreviation, e.g., IL, GA, etc.)

___________________________

______

__________

City:

State:

ZIP:

____________________________________

City

State

Zip

C

Check the box if one of the following apply.

K

If you are making the business income election to

fi rst return

fi nal return (If fi nal, write the date. _____________)

treat all nonbusiness income as business income,

D

If this is a fi nal return because you sold this business, write the date sold

check the box and write “0” on Lines 36 and 44.

(mm dd yy) ____ ____ ____ , and the new owner’s FEIN.

L

If you have completed the following federal forms,

___ ___ - ___ ___ ___ ___ ___ ___ ___

check the box and attach them to this return.

E

Special Apportionment Formulas. If you use a special apportionment

Federal Form 8886

Federal Sch. M-3

formula, check the appropriate box and see Special Apportionment

M

Check the box if you attached Form IL-4562.

Formula instructions.

N

Check the box if you attached Illinois

Financial organizations

Transportation companies

Schedule M (for businesses).

F

Check the box if you are classifi ed as an investment partnership.

O

Check the box if you attached Schedule 80/20.

G

Check the box if you made an IRC § 761 election.

Step 2: Figure your ordinary income or loss

1

1

Ordinary income or loss, or equivalent from federal Schedule K.

_______________ 00

2

2

Net income or loss from all rental real estate activities.

_______________ 00

3

3

Net income or loss from other rental activities.

_______________ 00

4

4

Portfolio income or loss.

_______________ 00

5

5

Net IRC Section 1231 gain or loss from involuntary conversions due to casualty and theft.

_______________ 00

6

All other items of income or loss that were not included in the computation of income or loss on

6

Page 1 of U.S. Form 1065 or 1065-B. See instructions. Identify:______________________________

_______________ 00

7

7

Add Lines 1 through 6. This is your ordinary income or loss.

_______________ 00

Step 3: Figure your unmodifi ed base income or loss

8

8

Charitable contributions.

_______________ 00

9

9

Expense deduction under IRC Section 179.

_______________ 00

10

10

Interest on investment indebtedness.

_______________ 00

11

All other items of expense that were not deducted in the computation of ordinary income or loss on

11

Page 1 of U.S. Form 1065 or 1065-B. See instructions. Identify: _______________________________

_______________ 00

12

12

Add Lines 8 through 11.

_______________ 00

13

13

Subtract Line 12 from Line 7. This amount is your total unmodifi ed base income or loss.

_______________ 00

IL-1065 (R-12/10)

NS

DR_______

Page 1 of 4

1

1 2

2 3

3