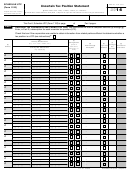

Instructions For Schedule Utp - Uncertain Tax Position Statement - Internal Revenue Service - 2010 Page 5

ADVERTISEMENT

Sample concise description. The

most cases, the description should not

issue is the potential application of

exceed a few sentences. Stating that a

corporation incurred costs of

section 707(a)(2) to recharacterize the

concise description is “Available upon

completing one business acquisition

distribution as a sale of a portion of the

Request” is not an adequate

and also incurred costs investigating

corporation’s Venture LLC interest.

description.

and partially negotiating potential

Example 12.

business acquisitions that were not

A concise description should not

Facts. The corporation incurred

completed. The costs were allocated

include an assessment of the hazards

costs during the tax year to clean up

between the completed and

of a tax position or an analysis of the

environmental contamination caused in

uncompleted acquisitions. The issue is

support for or against the tax position.

prior years by its operations at Site A.

whether the allocation of costs between

Site A contains both the corporation’s

Examples of Concise

uncompleted acquisitions and the

manufacturing plant and its corporate

Descriptions for Hypothetical

completed acquisition is appropriate.

headquarters. Based on its analysis

Fact Patterns

Example 11.

that the cleanup activities equally

The following examples set out a

Facts. The corporation is a

benefited both the manufacturing plant

description of hypothetical facts and the

member of Venture LLC, which is

and its corporate headquarters, the

uncertainties about a tax position that

treated as a U.S. partnership for tax

corporation allocated the environmental

would be reportable on Schedule UTP.

purposes. During the taxable year,

cleanup costs equally between them. It

Following each set of hypothetical facts,

Venture LLC raised funds through (i)

capitalized the portion of environmental

which would not be disclosed on the

admitting a new member for a cash

cleanup costs allocated to its

schedule, is an example of a sufficient

contribution and (ii) borrowing funds

manufacturing plant to inventory

concise description that would be

from a financial institution, using a loan

produced during the taxable year and

reported in Part III to disclose that

partially guaranteed by the corporation.

deducted the portion of environmental

hypothetical case.

Also during the tax year, Venture LLC

cleanup costs allocated to its corporate

made a cash distribution to the

headquarters. The corporation

Example 10.

corporation that caused its membership

established a reserve for financial

Facts. The corporation investigated

interest in Venture LLC to be reduced

accounting purposes in recognition of

and negotiated several potential

from 25% to 2%. The corporation has

the possibility that a portion of the

business acquisitions during the tax

taken the position that the cash

current year deduction of costs

year. One of the transactions was

distribution is properly characterized as

allocated to the corporate headquarters

completed during the tax year, but all

a nontaxable distribution that does not

might be reallocated to the

other negotiations failed and the other

exceed its basis in its Venture LLC

manufacturing plant.

potential transactions were abandoned

interest, but has established a reserve

Sample concise description. The

during the tax year. The corporation

for financial accounting purposes,

corporation incurred costs during the

deducted costs of investigating and

recognizing that the transaction might

tax year to clean up environmental

partially negotiating potential business

be recharacterized as a taxable sale of

contamination that was caused by its

acquisitions that were not completed,

a portion of its Venture LLC interest

activities in prior years at site A, which

and capitalized costs allocable to one

under section 707(a)(2).

contains both its manufacturing facility

business acquisition that was

Sample concise description. The

and its corporate headquarters. The

completed. The corporation established

corporation is a member of Venture

issue is the allocation of the cleanup

a reserve for financial accounting

LLC, which is treated as a U.S.

costs between X’s production and

purposes in recognition of the

partnership for tax purposes. The

non-production activities under section

possibility that the amount of costs

corporation received a cash distribution

263A.

allocated to the uncompleted

during the year from Venture LLC. The

acquisition attempts was excessive.

-5-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5