Instructions For Form 8275-Department Of The Treasury-Internal Revenue Service

ADVERTISEMENT

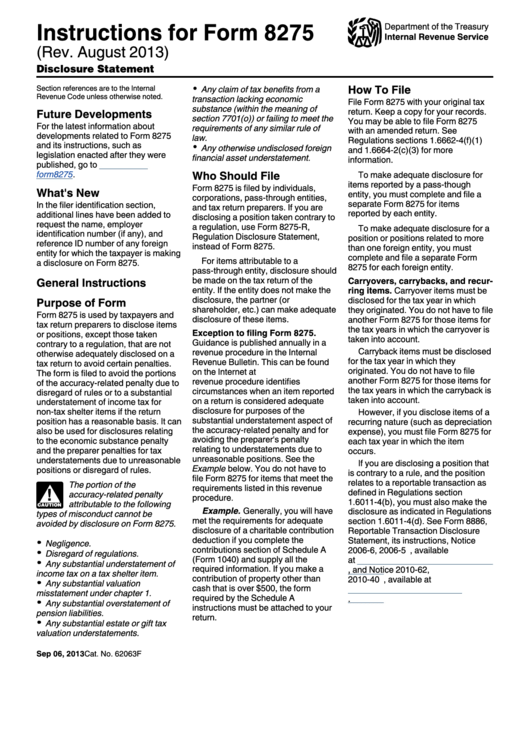

Instructions for Form 8275

Department of the Treasury

Internal Revenue Service

(Rev. August 2013)

Disclosure Statement

How To File

Section references are to the Internal

Any claim of tax benefits from a

Revenue Code unless otherwise noted.

transaction lacking economic

File Form 8275 with your original tax

substance (within the meaning of

return. Keep a copy for your records.

Future Developments

section 7701(o)) or failing to meet the

You may be able to file Form 8275

For the latest information about

requirements of any similar rule of

with an amended return. See

developments related to Form 8275

law.

Regulations sections 1.6662-4(f)(1)

and its instructions, such as

Any otherwise undisclosed foreign

and 1.6664-2(c)(3) for more

legislation enacted after they were

financial asset understatement.

information.

published, go to

Who Should File

form8275.

To make adequate disclosure for

items reported by a pass-though

Form 8275 is filed by individuals,

What's New

entity, you must complete and file a

corporations, pass-through entities,

separate Form 8275 for items

In the filer identification section,

and tax return preparers. If you are

reported by each entity.

additional lines have been added to

disclosing a position taken contrary to

request the name, employer

a regulation, use Form 8275-R,

To make adequate disclosure for a

identification number (if any), and

Regulation Disclosure Statement,

position or positions related to more

reference ID number of any foreign

instead of Form 8275.

than one foreign entity, you must

entity for which the taxpayer is making

complete and file a separate Form

For items attributable to a

a disclosure on Form 8275.

8275 for each foreign entity.

pass-through entity, disclosure should

be made on the tax return of the

General Instructions

Carryovers, carrybacks, and recur

entity. If the entity does not make the

ring items. Carryover items must be

disclosure, the partner (or

disclosed for the tax year in which

Purpose of Form

shareholder, etc.) can make adequate

they originated. You do not have to file

Form 8275 is used by taxpayers and

disclosure of these items.

another Form 8275 for those items for

tax return preparers to disclose items

the tax years in which the carryover is

Exception to filing Form 8275.

or positions, except those taken

taken into account.

Guidance is published annually in a

contrary to a regulation, that are not

Carryback items must be disclosed

revenue procedure in the Internal

otherwise adequately disclosed on a

for the tax year in which they

Revenue Bulletin. This can be found

tax return to avoid certain penalties.

originated. You do not have to file

on the Internet at IRS.gov. The

The form is filed to avoid the portions

another Form 8275 for those items for

revenue procedure identifies

of the accuracy-related penalty due to

the tax years in which the carryback is

circumstances when an item reported

disregard of rules or to a substantial

taken into account.

on a return is considered adequate

understatement of income tax for

disclosure for purposes of the

non-tax shelter items if the return

However, if you disclose items of a

substantial understatement aspect of

position has a reasonable basis. It can

recurring nature (such as depreciation

the accuracy-related penalty and for

also be used for disclosures relating

expense), you must file Form 8275 for

avoiding the preparer's penalty

to the economic substance penalty

each tax year in which the item

relating to understatements due to

and the preparer penalties for tax

occurs.

unreasonable positions. See the

understatements due to unreasonable

If you are disclosing a position that

Example below. You do not have to

positions or disregard of rules.

is contrary to a rule, and the position

file Form 8275 for items that meet the

relates to a reportable transaction as

The portion of the

requirements listed in this revenue

defined in Regulations section

accuracy-related penalty

!

procedure.

1.6011-4(b), you must also make the

attributable to the following

CAUTION

Example. Generally, you will have

disclosure as indicated in Regulations

types of misconduct cannot be

met the requirements for adequate

section 1.6011-4(d). See Form 8886,

avoided by disclosure on Form 8275.

disclosure of a charitable contribution

Reportable Transaction Disclosure

deduction if you complete the

Statement, its instructions, Notice

Negligence.

contributions section of Schedule A

2006-6, 2006-5 I.R.B. 385, available

Disregard of regulations.

(Form 1040) and supply all the

at

Any substantial understatement of

required information. If you make a

ar10.html, and Notice 2010-62,

income tax on a tax shelter item.

contribution of property other than

2010-40 I.R.B. 411, available at

Any substantial valuation

cash that is over $500, the form

irb/2010-40_IRB/

misstatement under chapter 1.

required by the Schedule A

ar09.html.

Any substantial overstatement of

instructions must be attached to your

pension liabilities.

return.

Any substantial estate or gift tax

valuation understatements.

Sep 06, 2013

Cat. No. 62063F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4