Prepared Food And Beverage Tax - City Of Suffolk

ADVERTISEMENT

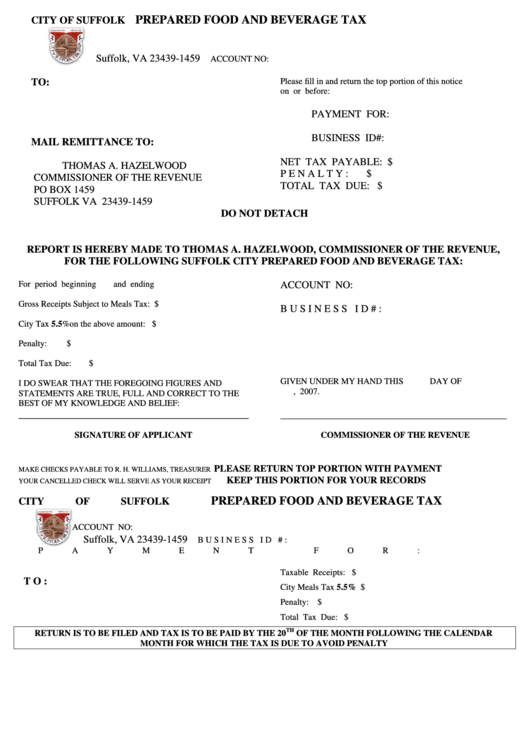

PREPARED FOOD AND BEVERAGE TAX

CITY OF SUFFOLK

P.O. Box 1459

Suffolk, VA 23439-1459

ACCOUNT NO:

TO:

Please fill in and return the top portion of this notice

on or before:

PAYMENT FOR:

BUSINESS ID#:

MAIL REMITTANCE TO:

NET TAX PAYABLE:

$

THOMAS A. HAZELWOOD

PENALTY:

$

COMMISSIONER OF THE REVENUE

TOTAL TAX DUE:

$

PO BOX 1459

SUFFOLK VA 23439-1459

DO NOT DETACH

REPORT IS HEREBY MADE TO THOMAS A. HAZELWOOD, COMMISSIONER OF THE REVENUE,

FOR THE FOLLOWING SUFFOLK CITY PREPARED FOOD AND BEVERAGE TAX:

For period beginning

and ending

ACCOUNT NO:

Gross Receipts Subject to Meals Tax: $

BUSINESS ID#:

City Tax 5.5% on the above amount: $

Penalty:

$

Total Tax Due:

$

GIVEN UNDER MY HAND THIS

DAY OF

I DO SWEAR THAT THE FOREGOING FIGURES AND

, 2007.

STATEMENTS ARE TRUE, FULL AND CORRECT TO THE

BEST OF MY KNOWLEDGE AND BELIEF:

____________________________________________

____________________________________________________

SIGNATURE OF APPLICANT

COMMISSIONER OF THE REVENUE

PLEASE RETURN TOP PORTION WITH PAYMENT

MAKE CHECKS PAYABLE TO R. H. WILLIAMS, TREASURER

KEEP THIS PORTION FOR YOUR RECORDS

YOUR CANCELLED CHECK WILL SERVE AS YOUR RECEIPT

PREPARED FOOD AND BEVERAGE TAX

CITY OF SUFFOLK

P.O. Box 1459

ACCOUNT NO:

Suffolk, VA 23439-1459

BUSINESS ID #:

PAYMENT FOR:

Taxable Receipts:

$

TO:

City Meals Tax 5.5%

$

Penalty:

$

Total Tax Due:

$

TH

RETURN IS TO BE FILED AND TAX IS TO BE PAID BY THE 20

OF THE MONTH FOLLOWING THE CALENDAR

MONTH FOR WHICH THE TAX IS DUE TO AVOID PENALTY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1