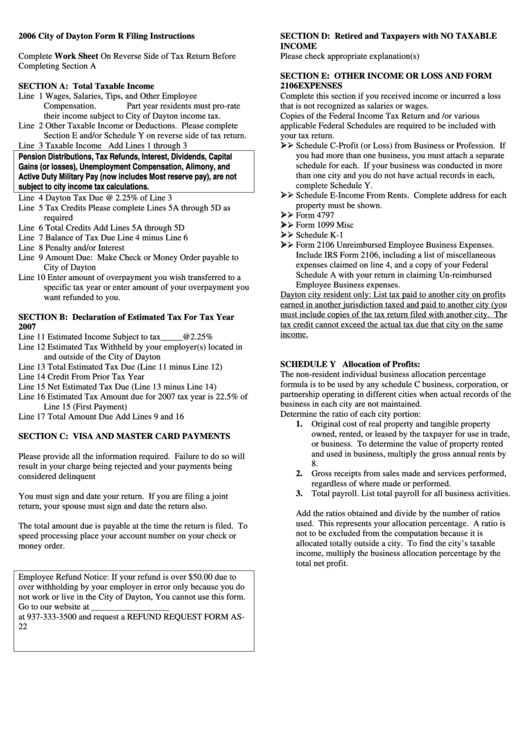

2006 City Of Dayton Form R Filing Instructions

ADVERTISEMENT

2006 City of Dayton Form R Filing Instructions

SECTION D: Retired and Taxpayers with NO TAXABLE

INCOME

Complete Work Sheet On Reverse Side of Tax Return Before

Please check appropriate explanation(s)

Completing Section A

SECTION E: OTHER INCOME OR LOSS AND FORM

SECTION A: Total Taxable Income

2106 EXPENSES

Line 1 Wages, Salaries, Tips, and Other Employee

Complete this section if you received income or incurred a loss

Compensation.

Part year residents must pro-rate

that is not recognized as salaries or wages.

their income subject to City of Dayton income tax.

Copies of the Federal Income Tax Return and /or various

Line 2 Other Taxable Income or Deductions. Please complete

applicable Federal Schedules are required to be included with

Section E and/or Schedule Y on reverse side of tax return.

your tax return.

Line 3 Taxable Income Add Lines 1 through 3

Schedule C-Profit (or Loss) from Business or Profession. If

you had more than one business, you must attach a separate

Pension Distributions, Tax Refunds, Interest, Dividends, Capital

schedule for each. If your business was conducted in more

Gains (or losses), Unemployment Compensation, Alimony, and

than one city and you do not have actual records in each,

Active Duty Military Pay (now includes Most reserve pay), are not

complete Schedule Y.

subject to city income tax calculations.

Schedule E-Income From Rents. Complete address for each

Line 4 Dayton Tax Due @ 2.25% of Line 3

property must be shown.

Line 5 Tax Credits Please complete Lines 5A through 5D as

Form 4797

required

Form 1099 Misc

Line 6 Total Credits Add Lines 5A through 5D

Schedule K-1

Line 7 Balance of Tax Due Line 4 minus Line 6

Form 2106 Unreimbursed Employee Business Expenses.

Line 8 Penalty and/or Interest

Include IRS Form 2106, including a list of miscellaneous

Line 9 Amount Due: Make Check or Money Order payable to

expenses claimed on line 4, and a copy of your Federal

City of Dayton

Schedule A with your return in claiming Un-reimbursed

Line 10 Enter amount of overpayment you wish transferred to a

Employee Business expenses.

specific tax year or enter amount of your overpayment you

Dayton city resident only: List tax paid to another city on profits

want refunded to you.

earned in another jurisdiction taxed and paid to another city (you

must include copies of the tax return filed with another city. The

SECTION B: Declaration of Estimated Tax For Tax Year

tax credit cannot exceed the actual tax due that city on the same

2007

income.

Line 11 Estimated Income Subject to tax_____@2.25%

Line 12 Estimated Tax Withheld by your employer(s) located in

and outside of the City of Dayton

SCHEDULE Y Allocation of Profits:

Line 13 Total Estimated Tax Due (Line 11 minus Line 12)

The non-resident individual business allocation percentage

Line 14 Credit From Prior Tax Year

formula is to be used by any schedule C business, corporation, or

Line 15 Net Estimated Tax Due (Line 13 minus Line 14)

partnership operating in different cities when actual records of the

Line 16 Estimated Tax Amount due for 2007 tax year is 22.5% of

business in each city are not maintained.

Line 15 (First Payment)

Determine the ratio of each city portion:

Line 17 Total Amount Due Add Lines 9 and 16

1.

Original cost of real property and tangible property

owned, rented, or leased by the taxpayer for use in trade,

SECTION C: VISA AND MASTER CARD PAYMENTS

or business. To determine the value of property rented

and used in business, multiply the gross annual rents by

Please provide all the information required. Failure to do so will

8.

result in your charge being rejected and your payments being

2.

Gross receipts from sales made and services performed,

considered delinquent

regardless of where made or performed.

3.

Total payroll. List total payroll for all business activities.

You must sign and date your return. If you are filing a joint

return, your spouse must sign and date the return also.

Add the ratios obtained and divide by the number of ratios

used. This represents your allocation percentage. A ratio is

The total amount due is payable at the time the return is filed. To

not to be excluded from the computation because it is

speed processing place your account number on your check or

allocated totally outside a city. To find the city’s taxable

money order.

income, multiply the business allocation percentage by the

total net profit.

Employee Refund Notice: If your refund is over $50.00 due to

over withholding by your employer in error only because you do

not work or live in the City of Dayton, You cannot use this form.

Go to our website at or contact our office

at 937-333-3500 and request a REFUND REQUEST FORM AS-

22

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1