Form Sn 2007(3) - Special Notice Legislation Granting A Connecticut Sales And Use Tax Exemption For Sales Of Compact Fluorescent Light Bulbs - Connecticut Department Of Revenue Services - 2007

ADVERTISEMENT

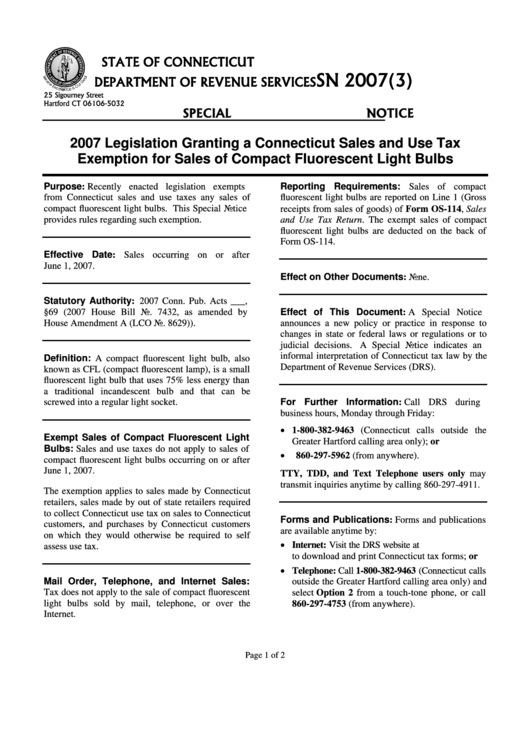

STATE OF CONNECTICUT

SN 2007(3)

DEPARTMENT OF REVENUE SERVICES

25 Sigourney Street

Hartford CT 06106-5032

SPECIAL NOTICE

2007 Legislation Granting a Connecticut Sales and Use Tax

Exemption for Sales of Compact Fluorescent Light Bulbs

Purpose: Recently enacted legislation exempts

Reporting Requirements: Sales of compact

from Connecticut sales and use taxes any sales of

fluorescent light bulbs are reported on Line 1 (Gross

compact fluorescent light bulbs. This Special Notice

receipts from sales of goods) of Form OS-114, Sales

provides rules regarding such exemption.

and Use Tax Return. The exempt sales of compact

fluorescent light bulbs are deducted on the back of

Form OS-114.

Effective Date: Sales occurring on or after

June 1, 2007.

Effect on Other Documents: None.

Statutory Authority: 2007 Conn. Pub. Acts ___,

Effect of This Document: A Special Notice

§69 (2007 House Bill No. 7432, as amended by

House Amendment A (LCO No. 8629)).

announces a new policy or practice in response to

changes in state or federal laws or regulations or to

judicial decisions.

A Special Notice indicates an

informal interpretation of Connecticut tax law by the

Definition: A compact fluorescent light bulb, also

Department of Revenue Services (DRS).

known as CFL (compact fluorescent lamp), is a small

fluorescent light bulb that uses 75% less energy than

a traditional incandescent bulb and that can be

For Further Information: Call DRS during

screwed into a regular light socket.

business hours, Monday through Friday:

• 1-800-382-9463 (Connecticut calls outside the

Exempt Sales of Compact Fluorescent Light

Greater Hartford calling area only); or

Bulbs: Sales and use taxes do not apply to sales of

•

860-297-5962 (from anywhere).

compact fluorescent light bulbs occurring on or after

June 1, 2007.

TTY, TDD, and Text Telephone users only may

transmit inquiries anytime by calling 860-297-4911.

The exemption applies to sales made by Connecticut

retailers, sales made by out of state retailers required

to collect Connecticut use tax on sales to Connecticut

Forms and Publications: Forms and publications

customers, and purchases by Connecticut customers

are available anytime by:

on which they would otherwise be required to self

• Internet: Visit the DRS website at

assess use tax.

to download and print Connecticut tax forms; or

• Telephone: Call 1-800-382-9463 (Connecticut calls

Mail Order, Telephone, and Internet Sales:

outside the Greater Hartford calling area only) and

Tax does not apply to the sale of compact fluorescent

select Option 2 from a touch-tone phone, or call

light bulbs sold by mail, telephone, or over the

860-297-4753 (from anywhere).

Internet

.

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2