40-128

PRINT FORM

CLEAR FORM

(Rev.9-11/11)

b.

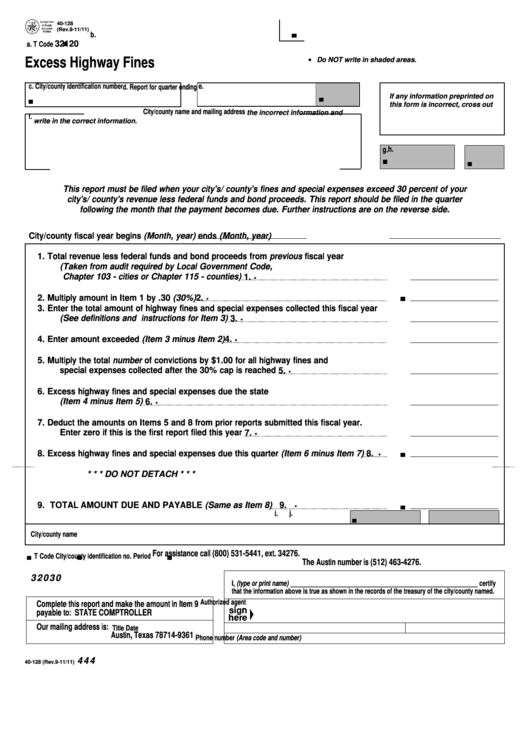

32120

a. T Code

Excess Highway Fines

Do NOT write in shaded areas.

c. City/county identification number

e.

d. Report for quarter ending

If any information preprinted on

this form is incorrect, cross out

City/county name and mailing address

the incorrect information and

f.

write in the correct information.

h.

g.

This report must be filed when your city's/ county's fines and special expenses exceed 30 percent of your

city's/ county's revenue less federal funds and bond proceeds. This report should be filed in the quarter

following the month that the payment becomes due. Further instructions are on the reverse side.

City/county fiscal year begins (Month, year)

ends (Month, year)

1. Total revenue less federal funds and bond proceeds from previous fiscal year

(Taken from audit required by Local Government Code,

.

Chapter 103 - cities or Chapter 115 - counties)

1.

.

2. Multiply amount in Item 1 by .30 (30%)

2.

3. Enter the total amount of highway fines and special expenses collected this fiscal year

.

(See definitions and instructions for Item 3)

3.

.

4. Enter amount exceeded (Item 3 minus Item 2)

4.

5. Multiply the total number of convictions by $1.00 for all highway fines and

.

special expenses collected after the 30% cap is reached

5.

6. Excess highway fines and special expenses due the state

.

(Item 4 minus Item 5)

6.

7. Deduct the amounts on Items 5 and 8 from prior reports submitted this fiscal year.

.

Enter zero if this is the first report filed this year

7.

.

8. Excess highway fines and special expenses due this quarter (Item 6 minus Item 7)

8.

* * * DO NOT DETACH * * *

.

9. TOTAL AMOUNT DUE AND PAYABLE (Same as Item 8)

9.

j.

i.

City/county name

For assistance call (800) 531-5441, ext. 34276.

T Code

City/county identification no.

Period

The Austin number is (512) 463-4276.

32030

I, (type or print name) _________________________________________________________ certify

that the information above is true as shown in the records of the treasury of the city/county named.

Authorized agent

Complete this report and make the amount in Item 9

payable to: STATE COMPTROLLER

Our mailing address is: P.O. Box 149361

Title

Date

Austin, Texas 78714-9361

Phone number (Area code and number)

444

40-128 (Rev.9-11/11)

1

1 2

2