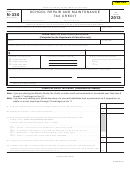

FORM N-330

(REV. 2004)

PAGE 2

Tax Liability Limitations (Not to be completed by Form N-20 and Form N-35 filers)

14. a Individuals — Enter tax liability amount from Form N-11, Form N-12, or, if applicable, Form N-15 .......

b Corporations — Enter tax liability from Form N-30 ................................................................................

c Other filers — Enter your income tax liability, before credits, from the applicable form .........................

14

15. If you are claiming other credits, complete the credit worksheet in the instructions and enter the

total here....................................................................................................................................................

15

16. Line 14 minus line 15. This represents your income tax liability, as adjusted. If the result is zero or less

than zero, enter zero on line16 ..................................................................................................................

16

17. Total credit allowed — Enter the smaller of line 13 or line 16. This is your school repair and

maintenance tax credit allowable for the year. Enter this amount also, rounded to the nearest dollar

for individual taxpayers, on the appropriate line for the credit on Schedule CR (for Form N-11, N-12,

N-15, N-30, and N-70NP filers), or on Form N-40, Schedule E (for the estate's or trust's share),

whichever is applicable ..............................................................................................................................

17

18. Line 13 minus line 17 (see instructions). This represents your carryover of unused credit. The amount

of any unused tax credit may be carried over and used as a credit against your income tax liability in

subsequent years until exhausted..............................................................................................................

18

FORM N-330

1

1 2

2