Sales And Use Tax Return Form - St. John The Baptist Parish

ADVERTISEMENT

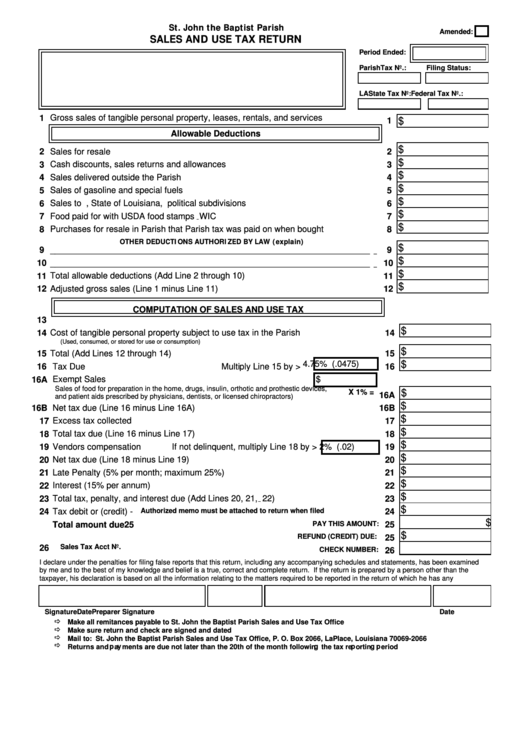

St. John the Baptist Parish

Amended:

SALES AND USE TAX RETURN

Period Ended:

ParishTax No.:

Filing Status:

LAState Tax No:

Federal Tax No.:

Gross sales of tangible personal property, leases, rentals, and services

1

$

1

Allowable Deductions

$

2

Sales for resale

2

$

3

Cash discounts, sales returns and allowances

3

$

Sales delivered outside the Parish

4

4

$

5

Sales of gasoline and special fuels

5

$

6

Sales to U.S. Government, State of Louisiana, political subdivisions

6

$

Food paid for with USDA food stamps WIC

7

7

$

Purchases for resale in Parish that Parish tax was paid on when bought

8

8

OTHER DEDUCTIONS AUTHORIZED BY LAW (explain)

$

9

____________________________________________________________________

9

$

____________________________________________________________________

10

10

$

Total allowable deductions (Add Line 2 through 10)

11

11

$

12

Adjusted gross sales (Line 1 minus Line 11)

12

COMPUTATION OF SALES AND USE TAX

13

$

14

Cost of tangible personal property subject to use tax in the Parish

14

(Used, consumed, or stored for use or consumption)

$

Total (Add Lines 12 through 14)

15

15

4.75% (.0475)

$

Tax Due

Multiply Line 15 by >

16

16

16A

Exempt Sales

$

Sales of food for preparation in the home, drugs, insulin, orthotic and prothestic devices,

X 1% =

$

16A

and patient aids prescribed by physicians, dentists, or licensed chiropractors)

$

Net tax due (Line 16 minus Line 16A)

16B

16B

$

Excess tax collected

17

17

$

18

Total tax due (Line 16 minus Line 17)

18

$

19

Vendors compensation

If not delinquent, multiply Line 18 by > 2% (.02)

19

$

Net tax due (Line 18 minus Line 19)

20

20

$

21

Late Penalty (5% per month; maximum 25%)

21

$

22

Interest (15% per annum)

22

$

Total tax, penalty, and interest due (Add Lines 20, 21, 22)

23

23

$

Tax debit or (credit) -

Authorized memo must be attached to return when filed

24

24

$

PAY THIS AMOUNT:

25

Total amount due

25

$

REFUND (CREDIT) DUE:

25

Sales Tax Acct No.

26

CHECK NUMBER:

26

I declare under the penalties for filing false reports that this return, including any accompanying schedules and statements, has been examined

by me and to the best of my knowledge and belief is a true, correct and complete return. If the return is prepared by a person other than the

taxpayer, his declaration is based on all the information relating to the matters required to be reported in the return of which he has any

Signature

Date

Preparer Signature

Date

Make all remitances payable to St. John the Baptist Parish Sales and Use Tax Office

Make sure return and check are signed and dated

Mail to: St. John the Baptist Parish Sales and Use Tax Office, P. O. Box 2066, LaPlace, Louisiana 70069-2066

Returns and payments are due not later than the 20th of the month following the tax reporting period

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1