Partnership Schedule Rz Of Gr-1065 City Of Grand Rapids Income Tax

ADVERTISEMENT

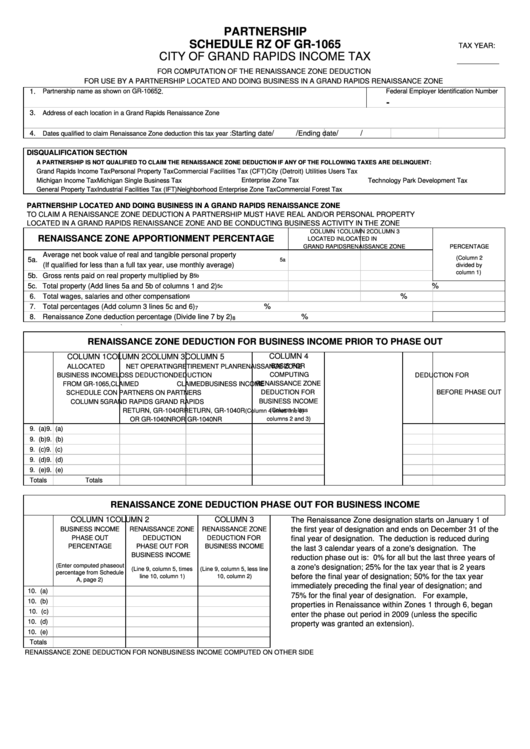

PARTNERSHIP

SCHEDULE RZ OF GR-1065

TAX YEAR:

CITY OF GRAND RAPIDS INCOME TAX

FOR COMPUTATION OF THE RENAISSANCE ZONE DEDUCTION

FOR USE BY A PARTNERSHIP LOCATED AND DOING BUSINESS IN A GRAND RAPIDS RENAISSANCE ZONE

1.

Partnership name as shown on GR-1065

2.

Federal Employer Identification Number

-

3.

Address of each location in a Grand Rapids Renaissance Zone

4.

Dates qualified to claim Renaissance Zone deduction this tax year :

Starting date

/

/

Ending date

/

/

DISQUALIFICATION SECTION

A PARTNERSHIP IS NOT QUALIFIED TO CLAIM THE RENAISSANCE ZONE DEDUCTION IF ANY OF THE FOLLOWING TAXES ARE DELINQUENT:

Grand Rapids Income Tax

Personal Property Tax

Commercial Facilities Tax (CFT)

City (Detroit) Utilities Users Tax

Michigan Income Tax

Michigan Single Business Tax

Enterprise Zone Tax

Technology Park Development Tax

General Property Tax

Industrial Facilities Tax (IFT)

Neighborhood Enterprise Zone Tax

Commercial Forest Tax

PARTNERSHIP LOCATED AND DOING BUSINESS IN A GRAND RAPIDS RENAISSANCE ZONE

TO CLAIM A RENAISSANCE ZONE DEDUCTION A PARTNERSHIP MUST HAVE REAL AND/OR PERSONAL PROPERTY

LOCATED IN A GRAND RAPIDS RENAISSANCE ZONE AND BE CONDUCTING BUSINESS ACTIVITY IN THE ZONE

COLUMN 1

COLUMN 2

COLUMN 3

RENAISSANCE ZONE APPORTIONMENT PERCENTAGE

LOCATED IN

LOCATED IN

GRAND RAPIDS

RENAISSANCE ZONE

PERCENTAGE

Average net book value of real and tangible personal property

(Column 2

5a.

5a

(If qualified for less than a full tax year, use monthly average)

divided by

column 1)

5b. Gross rents paid on real property multiplied by 8

5b

5c. Total property (Add lines 5a and 5b of columns 1 and 2)

%

5c

6. Total wages, salaries and other compensation

%

6

7. Total percentages (Add column 3 lines 5c and 6)

%

7

8. Renaissance Zone deduction percentage (Divide line 7 by 2)

%

8

`

RENAISSANCE ZONE DEDUCTION FOR BUSINESS INCOME PRIOR TO PHASE OUT

COLUMN 1

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 5

BASIS FOR

ALLOCATED

NET OPERATING

RETIREMENT PLAN

RENAISSANCE ZONE

COMPUTING

BUSINESS INCOME

LOSS DEDUCTION

DEDUCTION

DEDUCTION FOR

RENAISSANCE ZONE

FROM GR-1065,

CLAIMED

CLAIMED

BUSINESS INCOME

SCHEDULE C

ON PARTNERS

ON PARTNERS

DEDUCTION FOR

BEFORE PHASE OUT

BUSINESS INCOME

COLUMN 5

GRAND RAPIDS

GRAND RAPIDS

RETURN, GR-1040R RETURN, GR-1040R

(Column 1 less

(Column 4 times line 8)

OR GR-1040NR

OR GR-1040NR

columns 2 and 3)

9. (a)

9. (a)

9. (b)

9. (b)

9. (c)

9. (c)

9. (d)

9. (d)

9. (e)

9. (e)

Totals

Totals

RENAISSANCE ZONE DEDUCTION PHASE OUT FOR BUSINESS INCOME

COLUMN 1

COLUMN 2

COLUMN 3

The Renaissance Zone designation starts on January 1 of

BUSINESS INCOME

RENAISSANCE ZONE

RENAISSANCE ZONE

the first year of designation and ends on December 31 of the

PHASE OUT

DEDUCTION

DEDUCTION FOR

final year of designation. The deduction is reduced during

PERCENTAGE

PHASE OUT FOR

BUSINESS INCOME

the last 3 calendar years of a zone's designation. The

BUSINESS INCOME

reduction phase out is: 0% for all but the last three years of

(Enter computed phaseout

a zone's designation; 25% for the tax year that is 2 years

(Line 9, column 5, times

(Line 9, column 5, less line

percentage from Schedule

before the final year of designation; 50% for the tax year

line 10, column 1)

10, column 2)

A, page 2)

immediately preceding the final year of designation; and

10. (a)

75% for the final year of designation. For example,

10. (b)

properties in Renaissance within Zones 1 through 6, began

10. (c)

enter the phase out period in 2009 (unless the specific

10. (d)

property was granted an extension).

10. (e)

Totals

RENAISSANCE ZONE DEDUCTION FOR NONBUSINESS INCOME COMPUTED ON OTHER SIDE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2