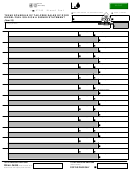

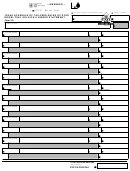

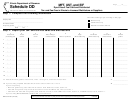

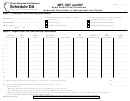

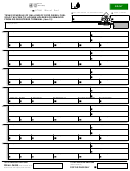

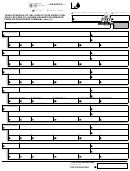

Form Rmft-33-Df - Schedule Dd-1 - Tax-Free Sales Of Dyed Diesel Fuel Products To Other Than A Distributor Or Supplier In Illinois - 2010 Page 2

ADVERTISEMENT

General Instructions

Step-by-Step Instructions

What is dyed diesel fuel?

When do I fi le this schedule?

Step 1: Complete the following

Dyed diesel fuel is any special fuel that has been

You must fi le Schedule DD-1 with Form RMFT-5,

dyed per Section 4d of the Motor Fuel Tax Law.

Motor Fuel Distributor/Supplier Tax Return.

information

Write your company name, your license number,

What sales must I report on

What records must I keep?

and the period for which you are reporting.

Schedule DD-1?

You are required by law to keep books and records

You may make tax free sales of dyed diesel to

showing all purchases, receipts, losses through any

Step 2: Report your nontaxable sales

someone other than a licensed distributor or

cause, sales, distributions, and use of fuels.

Lines 1 through 10 —

licensed supplier for non-highway purposes if the

fuel is:

What if I need additional assistance?

Column 1 - Write the purchaser’s complete name.

•

delivered from a vehicle designed for the specifi c

If you have questions about this schedule, write to

purpose of such sales and delivered directly into

us at:

Column 2 - Write the purchaser’s street address,

a stationary bulk storage tank that displays the

city, state (using the two-character U.S. Post Offi ce

MOTOR FUEL TAX

dyed diesel notice required by section 4f of the

abbreviation), and ZIP code.

ILLINOIS DEPARTMENT OF REVENUE

Motor Fuel Tax Law,

PO BOX 19477

•

delivered from a vehicle designed for the specifi c

Column 3 - Write one fuel use code per line. You

SPRINGFIELD, ILLINOIS 62794-9477

purpose of such sales and delivered directly into

must identify the actual use when listing fuel use

the fuel supply tanks of non-highway vehicles

code “O”.

or call our Springfi eld offi ce week days between

that are not required to be registered for highway

8:00 a.m. and 4:30 p.m. at 217 782-2291

Column 4 - Write the number of total gallons.

use, or

•

dispensed from a dyed diesel fuel dispensing

Line 11 - Add the total monthly gallons reported in

facility that has withdrawal facilities that are not

Column 4, Lines 1 through 10.

readily accessible to and are not capable of dis-

Line 12 - If you are fi ling only one Schedule DD-1,

pensing dyed diesel fuel into the fuel supply tank

write the amount from Line 11 on Line 12 and on

of a motor vehicle. A dispensing facility that has

Form RMFT-5, Line 8b, Column 3. If you are fi ling

withdrawal facilities that are “not readily accesible

more than one Schedule DD-1, add Line 11 from

to and are not capable of dispensing into the fuel

each schedule, and write the total on Line 12 of the

supply tank of a motor vehicle” means:

last page. Also write this amount on Form RMFT-5,

• a dispenser hose that is short enough so that

Line 8b, Column 3.

it will not reach the fuel supply tank of a motor

vehicle; or

• a dispenser that is enclosed by a fence or

other physical barrier so that a vehicle cannot

pull alongside the dispenser to permit fueling.

You must report your motor fuel tax free sales of

dyed diesel made to someone other than a

licensed distributor or supplier for a use other than

in highway vehicles. If you report any sales made to

a licensed distributor or supplier or fuel used by your

own company, you will be required to fi le amended

schedules and an amended return.

RMFT-33-DF back (R-08/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2