Form 740np-Wh - Kentucky Nonresident Income Tax Withholding On Distributive Share Income Transmittal Report And Composite Income Tax Return

ADVERTISEMENT

*1000020292*

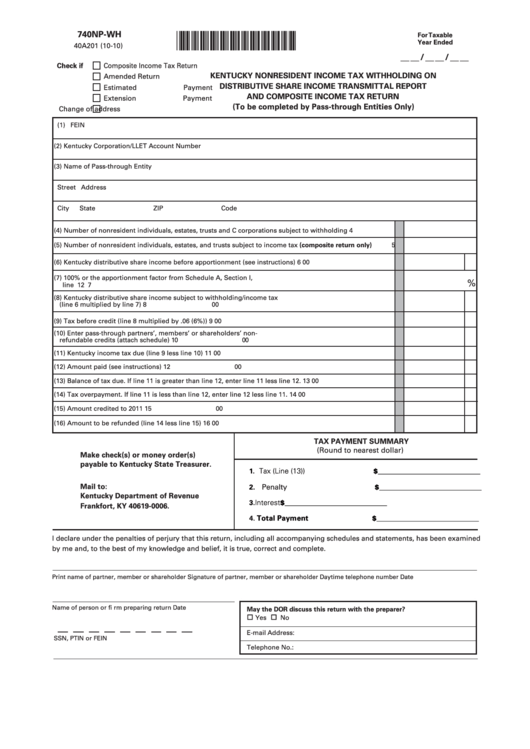

740NP-WH

For Taxable

Year Ended

40A201 (10-10)

__ __ / __ __ / __ __

Check if

Composite Income Tax Return

KENTUCKY NONRESIDENT INCOME TAX WITHHOLDING ON

Amended Return

DISTRIBUTIVE SHARE INCOME TRANSMITTAL REPORT

Estimated Payment

AND COMPOSITE INCOME TAX RETURN

Extension Payment

(To be completed by Pass-through Entities Only)

Change of address

(1) FEIN

(2) Kentucky Corporation/LLET Account Number

(3) Name of Pass-through Entity

Street Address

City

State

ZIP Code

(4) Number of nonresident individuals, estates, trusts and C corporations subject to withholding

4

(5) Number of nonresident individuals, estates, and trusts subject to income tax (composite return only)

5

(6) Kentucky distributive share income before apportionment (see instructions)

6

00

(7) 100% or the apportionment factor from Schedule A, Section I,

%

line 12

7

(8) Kentucky distributive share income subject to withholding/income tax

(line 6 multiplied by line 7)

8

00

(9) Tax before credit (line 8 multiplied by .06 (6%))

9

00

(10) Enter pass-through partners’, members’ or shareholders’ non-

refundable credits (attach schedule)

10

00

(11) Kentucky income tax due (line 9 less line 10)

11

00

(12) Amount paid (see instructions)

12

00

(13) Balance of tax due. If line 11 is greater than line 12, enter line 11 less line 12.

13

00

(14) Tax overpayment. If line 11 is less than line 12, enter line 12 less line 11.

14

00

(15) Amount credited to 2011

15

00

(16) Amount to be refunded (line 14 less line 15)

16

00

TAX PAYMENT SUMMARY

(Round to nearest dollar)

Make check(s) or money order(s)

payable to Kentucky State Treasurer.

Tax (Line (13))

1.

$_____________________________

Mail to:

2.

Penalty

$_____________________________

Kentucky Department of Revenue

Interest

3.

$_____________________________

Frankfort, KY 40619-0006.

Total Payment

4.

$_____________________________

I declare under the penalties of perjury that this return, including all accompanying schedules and statements, has been examined

by me and, to the best of my knowledge and belief, it is true, correct and complete.

Print name of partner, member or shareholder

Signature of partner, member or shareholder

Daytime telephone number

Date

Name of person or fi rm preparing return

Date

May the DOR discuss this return with the preparer?

Yes

No

E-mail Address:

SSN, PTIN or FEIN

Telephone No.:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1