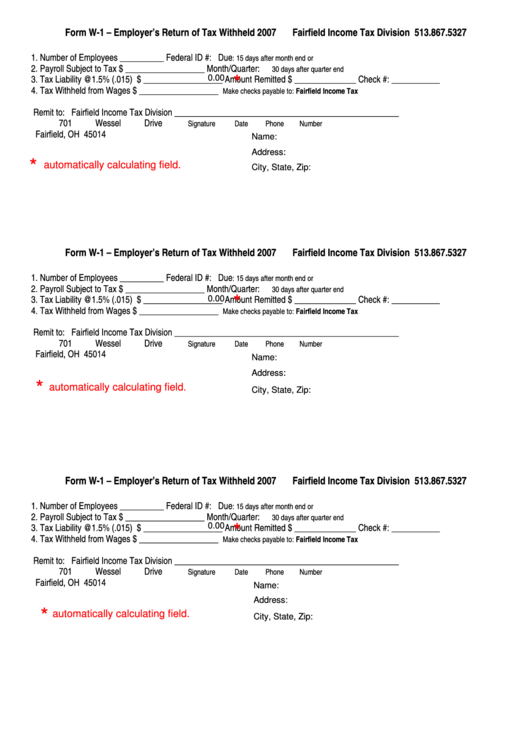

Form W-1 – Employer’s Return of Tax Withheld 2007

Fairfield Income Tax Division 513.867.5327

1. Number of Employees

__________

Federal ID #:

Due

: 15 days after month end or

2. Payroll Subject to Tax

$ __________________

Month/Quarter:

30 days after quarter end

3. Tax Liability @1.5% (.015) $ __________________

Amount Remitted $ ______________ Check #: ___________

0.00

*

4. Tax Withheld from Wages

$ __________________

Make checks payable to: Fairfield Income Tax

Remit to:

Fairfield Income Tax Division

___________________________________________________

701 Wessel Drive

Signature

Date

Phone Number

Fairfield, OH 45014

Name:

Address:

*

automatically calculating field.

City, State, Zip:

Form W-1 – Employer’s Return of Tax Withheld 2007

Fairfield Income Tax Division 513.867.5327

1. Number of Employees

__________

Federal ID #:

Due

: 15 days after month end or

2. Payroll Subject to Tax

$ __________________

Month/Quarter:

30 days after quarter end

3. Tax Liability @1.5% (.015) $ __________________

Amount Remitted $ ______________ Check #: ___________

*

0.00

4. Tax Withheld from Wages

$ __________________

Make checks payable to: Fairfield Income Tax

Remit to:

Fairfield Income Tax Division

___________________________________________________

701 Wessel Drive

Signature

Date

Phone Number

Fairfield, OH 45014

Name:

Address:

*

automatically calculating field.

City, State, Zip:

Form W-1 – Employer’s Return of Tax Withheld 2007

Fairfield Income Tax Division 513.867.5327

1. Number of Employees

__________

Federal ID #:

Due

: 15 days after month end or

2. Payroll Subject to Tax

$ __________________

Month/Quarter:

30 days after quarter end

0.00

3. Tax Liability @1.5% (.015) $ __________________

Amount Remitted $ ______________ Check #: ___________

*

4. Tax Withheld from Wages

$ __________________

Make checks payable to: Fairfield Income Tax

Remit to:

Fairfield Income Tax Division

___________________________________________________

701 Wessel Drive

Signature

Date

Phone Number

Fairfield, OH 45014

Name:

Address:

*

automatically calculating field.

City, State, Zip:

1

1