Form Rpd-41306c - Schedule Of Disbursements

ADVERTISEMENT

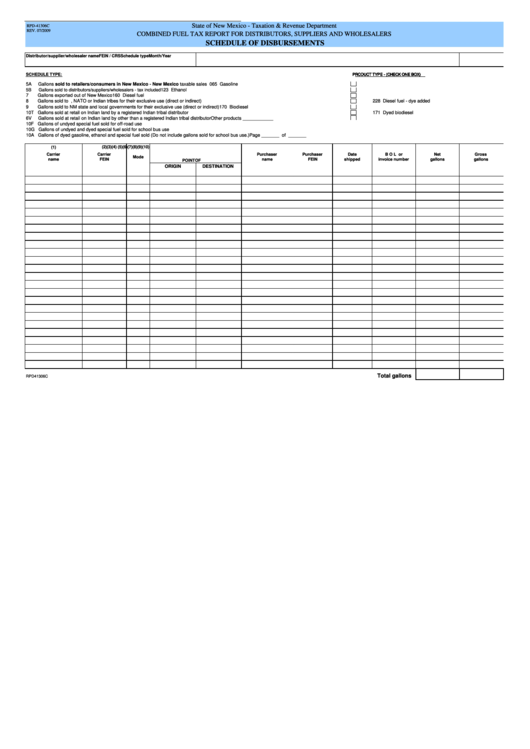

State of New Mexico - Taxation & Revenue Department

RPD-41306C

REV. 07/2009

COMBINED FUEL TAX REPORT FOR DISTRIBUTORS, SUPPLIERS AND WHOLESALERS

SCHEDULE OF DISBURSEMENTS

Distributor/supplier/wholesaler name

FEIN / CRS

Schedule type

Month/Year

PRODUCT TYPE - (CHECK ONE BOX)

SCHEDULE TYPE:

5A

Gallons sold to retailers/consumers in New Mexico - New Mexico taxable sales

065 Gasoline

5B

Gallons sold to distributors/suppliers/wholesalers - tax included

123 Ethanol

7

Gallons exported out of New Mexico

160 Diesel fuel

8

Gallons sold to U.S. Govt., NATO or Indian tribes for their exclusive use (direct or indirect)

228 Diesel fuel - dye added

9

Gallons sold to NM state and local governments for their exclusive use (direct or indirect)

170 Biodiesel

10T Gallons sold at retail on Indian land by a registered Indian tribal distributor

171 Dyed biodiesel

6V

Gallons sold at retail on Indian land by other than a registered Indian tribal distributor

Other products ____________

10F Gallons of undyed special fuel sold for off-road use

10G Gallons of undyed and dyed special fuel sold for school bus use

10A Gallons of dyed gasoline, ethanol and special fuel sold (Do not include gallons sold for school bus use.)

Page _______ of _______

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

Carrier

Carrier

Purchaser

Purchaser

Date

B O L or

Net

Gross

Mode

name

FEIN

name

FEIN

shipped

invoice number

gallons

gallons

POINT OF

ORIGIN

DESTINATION

Total gallons

RPD41306C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1