Form Pte-D - Owner Information - 2008

ADVERTISEMENT

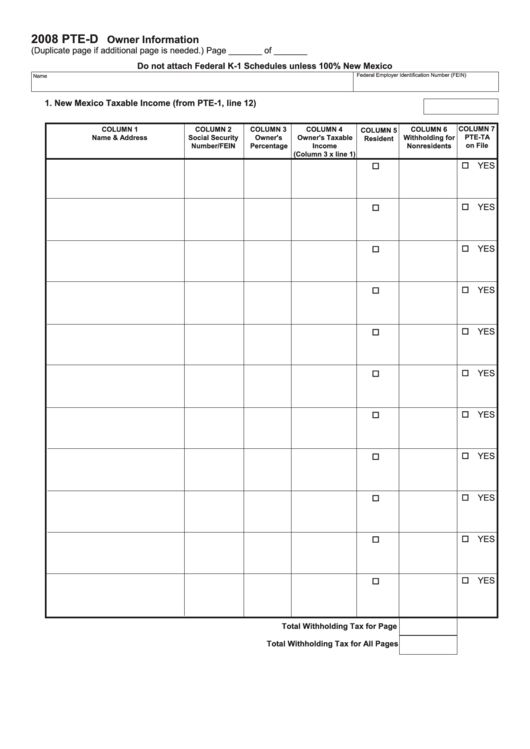

2008 PTE-D

Owner Information

(Duplicate page if additional page is needed.)

Page _______ of _______

Do not attach Federal K-1 Schedules unless 100% New Mexico

Federal Employer Identification Number (FEIN)

Name

1. New Mexico Taxable Income (from PTE-1, line 12) .................................................................

COLUMN 7

COLUMN 1

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 6

COLUMN 5

PTE-TA

Name & Address

Social Security

Owner's

Owner's Taxable

Withholding for

Resident

on File

Number/FEIN

Percentage

Income

Nonresidents

(Column 3 x line 1)

o YES

o

o YES

o

o YES

o

o YES

o

o YES

o

o YES

o

o YES

o

o YES

o

o YES

o

o YES

o

o YES

o

Total Withholding Tax for Page

Total Withholding Tax for All Pages

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2