Renewal Instructions

ADVERTISEMENT

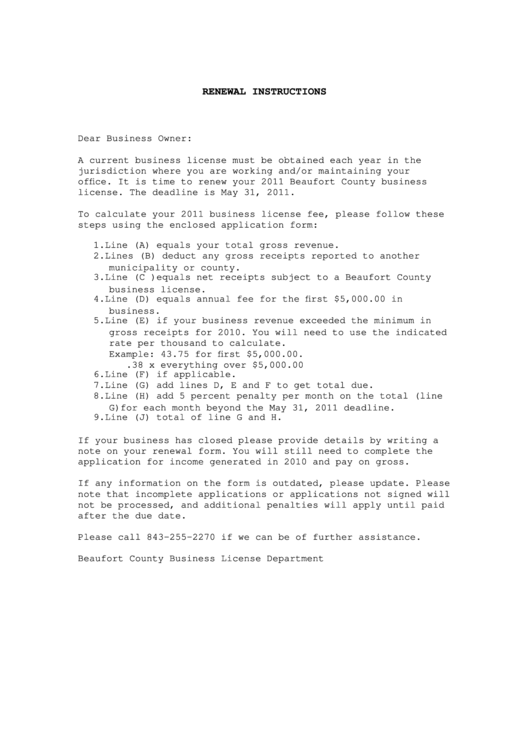

RENEWAL INSTRUCTIONS

Dear Business Owner:

A current business license must be obtained each year in the

jurisdiction where you are working and/or maintaining your

office. It is time to renew your 2011 Beaufort County business

license. The deadline is May 31, 2011.

To calculate your 2011 business license fee, please follow these

steps using the enclosed application form:

1. Line (A) equals your total gross revenue.

2. Lines (B) deduct any gross receipts reported to another

municipality or county.

3. Line (C )equals net receipts subject to a Beaufort County

business license.

4. Line (D) equals annual fee for the first $5,000.00 in

business.

5. Line (E) if your business revenue exceeded the minimum in

gross receipts for 2010. You will need to use the indicated

rate per thousand to calculate.

Example: 43.75 for first $5,000.00.

.38 x everything over $5,000.00

6. Line (F) if applicable.

7. Line (G) add lines D, E and F to get total due.

8. Line (H) add 5 percent penalty per month on the total (line

G)for each month beyond the May 31, 2011 deadline.

9. Line (J) total of line G and H.

If your business has closed please provide details by writing a

note on your renewal form. You will still need to complete the

application for income generated in 2010 and pay on gross.

If any information on the form is outdated, please update. Please

note that incomplete applications or applications not signed will

not be processed, and additional penalties will apply until paid

after the due date.

Please call 843-255-2270 if we can be of further assistance.

Beaufort County Business License Department

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1