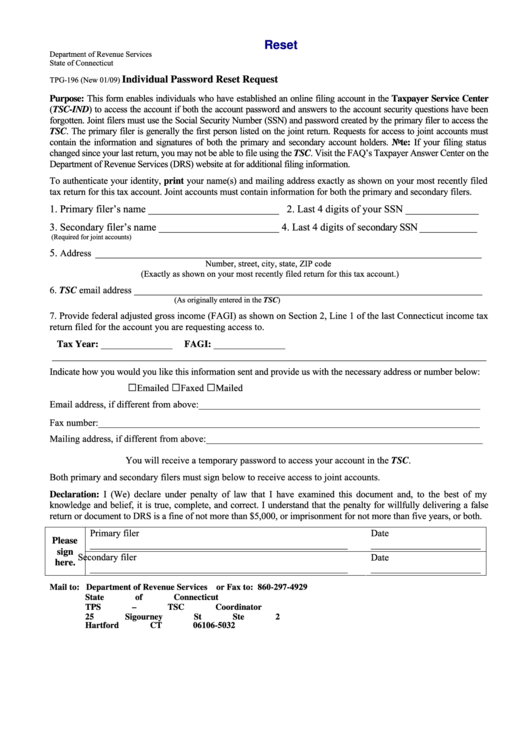

Reset

Department of Revenue Services

State of Connecticut

TPG-196 (New 01/09)

Individual Password Reset Request

Purpose: This form enables individuals who have established an online filing account in the Taxpayer Service Center

(TSC-IND) to access the account if both the account password and answers to the account security questions have been

forgotten. Joint filers must use the Social Security Number (SSN) and password created by the primary filer to access the

TSC. The primary filer is generally the first person listed on the joint return. Requests for access to joint accounts must

contain the information and signatures of both the primary and secondary account holders. Note: If your filing status

changed since your last return, you may not be able to file using the TSC. Visit the FAQ’s Taxpayer Answer Center on the

Department of Revenue Services (DRS) website at for additional filing information.

To authenticate your identity, print your name(s) and mailing address exactly as shown on your most recently filed

tax return for this tax account. Joint accounts must contain information for both the primary and secondary filers.

1. Primary filer’s name _________________________ 2. Last 4 digits of your SSN ______________

3. Secondary filer’s name _______________________

4. Last 4 digits of secondary SSN ___________

(Required for joint accounts)

5.

Address _________________________________________________________________________________

Number, street, city, state, ZIP code

(Exactly as shown on your most recently filed return for this tax account.)

6. TSC email address _________________________________________________________________________

(As originally entered in the TSC)

7. Provide federal adjusted gross income (FAGI) as shown on Section 2, Line 1 of the last Connecticut income tax

return filed for the account you are requesting access to.

Tax Year: _______________

FAGI: _______________

___________________________________________________________________________________

Indicate how you would you like this information sent and provide us with the necessary address or number below:

□

□

□

Emailed

Faxed

Mailed

Email address, if different from above: ___________________________________________________________

Fax number: ________________________________________________________________________________

Mailing address, if different from above:__________________________________________________________

You will receive a temporary password to access your account in the TSC.

Both primary and secondary filers must sign below to receive access to joint accounts.

Declaration: I (We) declare under penalty of law that I have examined this document and, to the best of my

knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false

return or document to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Primary filer

Date

Please

______________________________________________________

_______________________

sign

Secondary filer

Date

here.

______________________________________________________

_______________________

Mail to:

Department of Revenue Services

or Fax to: 860-297-4929

State of Connecticut

TPS – TSC Coordinator

25 Sigourney St Ste 2

Hartford CT 06106-5032

1

1