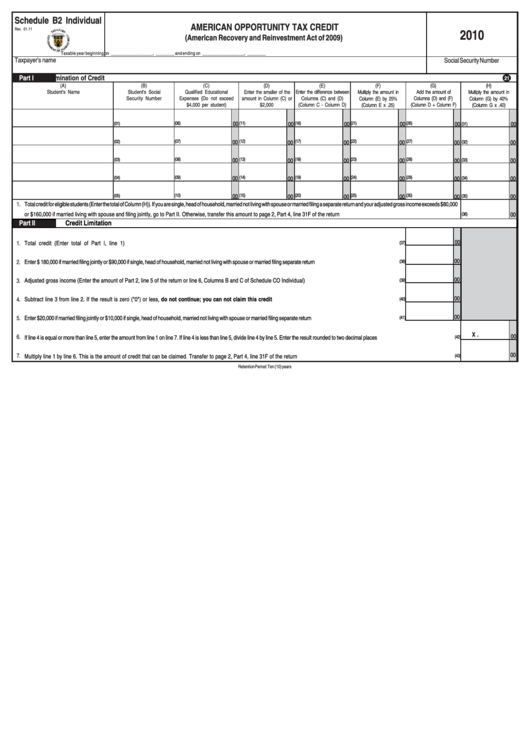

Schedule B2 Individual - American Opportunity Tax Credit - 2010

ADVERTISEMENT

Schedule B2 Individual

AMERICAN OPPORTUNITY TAX CREDIT

Rev. 01.11

2010

(American Recovery and Reinvestment Act of 2009)

Taxable year beginning on __________________, ________ and ending on __________________, ________

Taxpayer's name

Social Security Number

Part I

Determination of Credit

21

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

Student's Name

Student's Social

Qualified Educational

Enter the difference between

Add the amount of

Enter the smaller of the

Multiply the amount in

Multiply the amount in

Security Number

Expenses (Do not exceed

amount in Column (C) or

Columns (C) and (D)

Columns (D) and (F)

Column (E) by 25%

Column (G) by 40%

$4,000 per student)

$2,000

(Column C - Column D)

(Column E x .25)

(Column D + Column F)

(Column G x .40)

(06)

00

(11)

(16)

(21)

00

(26)

00

(01)

00

00

00

(31)

(07)

(12)

(17)

(22)

(27)

(02)

00

00

00

00

(32)

00

00

(08)

(13)

(18)

(23)

(28)

(03)

00

00

00

00

(33)

00

00

(14)

(19)

(24)

(29)

(04)

(09)

00

00

00

00

(34)

00

00

(05)

(10)

00

(15)

(20)

00

(25)

00

(30)

00

(35)

00

00

1.

Total credit for eligible students (Enter the total of Column (H)). If you are single, head of household, married not living with spouse or married filing a separate return and your adjusted gross income exceeds $80,000

or $160,000 if married living with spouse and filing jointly, go to Part II. Otherwise, transfer this amount to page 2, Part 4, line 31F of the return ....................................................................................

(36)

00

Part II

Credit Limitation

00

1.

Total credit (Enter total of Part I, line 1) ........................................................................................................................................................................................

(37)

00

2.

Enter $ 180,000 if married filing jointly or $90,000 if single, head of household, married not living with spouse or married filing separate return ...............................................................

(38)

00

Adjusted gross income (Enter the amount of Part 2, line 5 of the return or line 6, Columns B and C of Schedule CO Individual) ................................................................

3.

(39)

00

Subtract line 3 from line 2. If the result is zero ("0") or less, do not continue; you can not claim this credit ......................................................................................

4.

(40)

00

5.

Enter $20,000 if married filing jointly or $10,000 if single, head of household, married not living with spouse or married filing separate return ..................................................................

(41)

X .

00

6.

If line 4 is equal or more than line 5, enter the amount from line 1 on line 7. If line 4 is less than line 5, divide line 4 by line 5. Enter the result rounded to two decimal places ...........................................................

(42)

00

7.

Multiply line 1 by line 6. This is the amount of credit that can be claimed. Transfer to page 2, Part 4, line 31F of the return ............................................................................................................

(43)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1