Name of estate or trust

Federal employer identification number (FEIN)

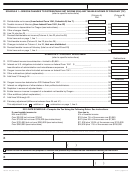

SCHEDULE 1—OREGON CHANGES TO DISTRIBUTABLE NET INCOME (DNI) AND TAXABLE INCOME OF FIDUCIARY (TIF)

(refer to specific instructions)

(Column A)

(Column B)

DNI

TIF

22. Distributable net income (from federal Form 1041, Schedule B, line 7) ...................22

23. Taxable income of fiduciary (from federal Form 1041, line 22) ........................................................................ 23

24. Difference in depreciation for Oregon (see instructions) ...............................................24

24

25. Other changes. Identify ___________________________________ .................................25

25

26. Line 24 plus line 25 .......................................................................................................26

26

27. Revised distributable net income (Column A, line 22 plus line 26)

Enter here and on page 1, line 1 ...................................................................................27

28. Total taxable income (Column B, line 23 plus line 26) .......................................................................................... 28

29. Changes included on Column A, line 26, that were distributed ........................................................................ 29

30. Revised taxable income of fiduciary (total or net of lines 28 and 29)

Enter here and on page 1, line 4 .......................................................................................................................... 30

SCHEDULE 2—FIDUCIARY ADJUSTMENT

(refer to specific instructions)

Subtractions

31. 2010 federal income tax subtraction—limited to $5,850 ..................................................................................... 31

32. Interest on U.S. obligations included in income on federal Form 1041 $ _______________,

less allocation of administration and miscellaneous expenses $ _______________ .......................................... 32

33. Oregon income tax refund included as income on federal Form 1041 ................................................................ 33

34. Other subtractions (attach explanation) ............................................................................................................... 34

35. Add lines 31 through 34 ....................................................................................................................................... 35

Additions

36. Oregon income tax deducted on 2010 federal Form 1041 .................................................................................. 36

37. Interest on obligations of other states or their political subdivisions ................................................................... 37

38. Depletion in excess of adjusted basis.................................................................................................................. 38

39. Estate taxes on income in respect of a decedent not taxable by Oregon ........................................................... 39

40. Other additions (attach explanation) .................................................................................................................... 40

41. Add lines 36 through 40 ....................................................................................................................................... 41

42. Fiduciary adjustment (difference between lines 35 and 41) ................................................................................. 42

This adjustment is an

addition or

subtraction on page 1, line 5.

2010 RATE SCHEDULE—Compute the Tax Using the Following Rates. See instructions.

If your taxable income is:

Your tax is:

Not over $3,050

5% of taxable income

Over $3,050 but not over $7,650

$153 plus 7% of the excess over $3,050

Over $7,650 but not over $125,000 (see instructions)

$475 plus 9% of the excess over $7,650

Over $125,000 but not over $250,000 (see instructions)

$11,036 plus 10.8% of the excess over $125,000

Over $250,000 (see instructions)

$24,536 plus 11% of the excess over $250,000

Under penalty of false swearing, I declare that the information in this return and any attachments is true, correct, and complete.

Signature of fiduciary

Print name

Date

x

Title (if applicable)

Daytime telephone number

(

)

Check the box to authorize the preparer to receive and provide any confidential tax information relating to this return.

Signature of preparer other than fiduciary

Print name and title

Date

x

Mailing address of preparer

Daytime telephone number

(

)

150-101-041 (Rev. 10-10)

Form 41, page 2 of 2

1

1 2

2