Form 92a202 - Estate Tax Return - 2011

ADVERTISEMENT

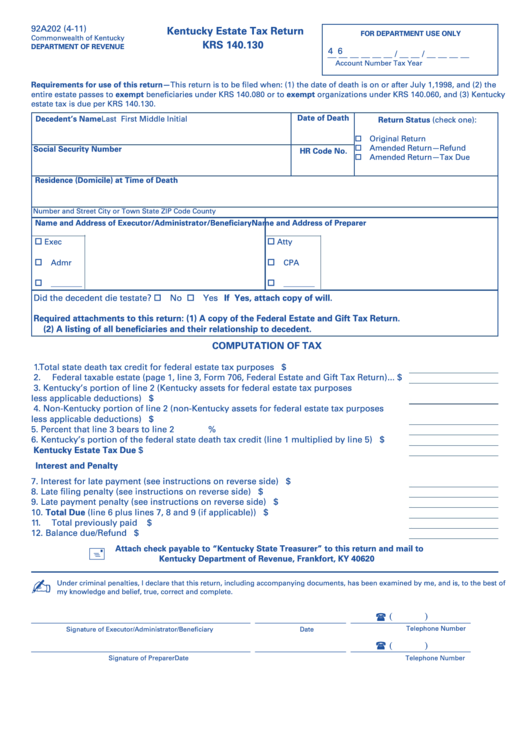

92A202 (4-11)

Kentucky Estate Tax Return

FOR DEPARTMENT USE ONLY

Commonwealth of Kentucky

KRS 140.130

DEPARTMENT OF REVENUE

4 6

__ __ __ __ __ __ / __ __ / __ __ __ __

Account Number

Tax

Year

Requirements for use of this return—This return is to be filed when: (1) the date of death is on or after July 1,1998, and (2) the

entire estate passes to exempt beneficiaries under KRS 140.080 or to exempt organizations under KRS 140.060, and (3) Kentucky

estate tax is due per KRS 140.130.

Date of Death

Decedent’s Name Last

First

Middle Initial

Return Status (check one):

Original Return

Amended Return—Refund

Social Security Number

HR Code No.

Amended Return—Tax Due

Residence (Domicile) at Time of Death

Number and Street

City or Town

State

ZIP Code

County

Name and Address of Executor/Administrator/Beneficiary

Name and Address of Preparer

Exec

Atty

Admr

CPA

________

________

Did the decedent die testate? No

Yes If Yes, attach copy of will.

Required attachments to this return: (1) A copy of the Federal Estate and Gift Tax Return.

(2) A listing of all beneficiaries and their relationship to decedent.

COMPUTATION OF TAX

1.

Total state death tax credit for federal estate tax purposes ............................................

$

2.

Federal taxable estate (page 1, line 3, Form 706, Federal Estate and Gift Tax Return) ...

$

3.

Kentucky’s portion of line 2 (Kentucky assets for federal estate tax purposes

less applicable deductions) ................................................................................................

$

4.

Non-Kentucky portion of line 2 (non-Kentucky assets for federal estate tax purposes

less applicable deductions) ................................................................................................

$

5.

Percent that line 3 bears to line 2 ......................................................................................

%

6.

Kentucky’s portion of the federal state death tax credit (line 1 multiplied by line 5) ....

$

Kentucky Estate Tax Due ...................................................................................................

$

Interest and Penalty

7.

Interest for late payment (see instructions on reverse side) ...........................................

$

8.

Late filing penalty (see instructions on reverse side) ......................................................

$

9.

Late payment penalty (see instructions on reverse side) ................................................

$

10.

Total Due (line 6 plus lines 7, 8 and 9 (if applicable)) .......................................................

$

11.

Total previously paid ..........................................................................................................

$

12. Balance due/Refund ............................................................................................................

$

Attach check payable to “Kentucky State Treasurer” to this return and mail to

Kentucky Department of Revenue, Frankfort, KY 40620

✍

Under criminal penalties, I declare that this return, including accompanying documents, has been examined by me, and is, to the best of

my knowledge and belief, true, correct and complete.

(

)

_____________________________________________________

______________________

_____________________________

Telephone Number

Signature of Executor/Administrator/Beneficiary

Date

(

)

_____________________________________________________

______________________

_____________________________

Signature of Preparer

Date

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1