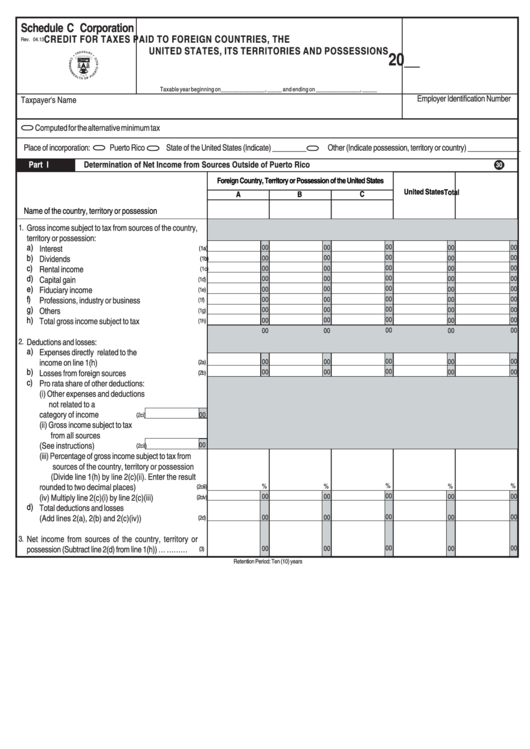

Schedule C Corporation - Credit For Taxes Paid To Foreign Countries, The United States, Its Territories And Possessions - 2013

ADVERTISEMENT

Schedule C Corporation

CREDIT FOR TAXES PAID TO FOREIGN COUNTRIES, THE

Rev. 04.13

UNITED STATES, ITS TERRITORIES AND POSSESSIONS

20__

Taxable year beginning on_______________, _____ and ending on _______________, _____

Employer Identification Number

Taxpayer's Name

Computed for the alternative minimum tax

Place of incorporation:

Puerto Rico

State of the United States (Indicate) _________

Other (Indicate possession, territory or country) ______________

Part I

Determination of Net Income from Sources Outside of Puerto Rico

30

Foreign Country, Territory or Possession of the United States

United States

Total

A

B

C

Name of the country, territory or possession ...................

1.

Gross income subject to tax from sources of the country,

territory or possession:

a)

00

00

00

Interest ......................................................................

00

00

(1a)

b)

00

00

00

Dividends .................................................................

00

00

(1b)

c)

00

00

00

Rental income ...........................................................

00

00

(1c)

d)

00

00

00

Capital gain ..............................................................

00

00

(1d)

e)

00

00

00

Fiduciary income .....................................................

00

00

(1e)

f)

00

00

00

Professions, industry or business .............................

00

00

(1f)

g)

00

00

00

Others ......................................................................

00

00

(1g)

h)

00

00

00

Total gross income subject to tax .............................

00

00

(1h)

00

00

00

00

00

2.

Deductions and losses:

a)

Expenses directly related to the

00

00

00

income on line 1(h) ...................................................

00

00

(2a)

b)

00

00

00

Losses from foreign sources ....................................

00

00

(2b)

c)

Pro rata share of other deductions:

(i) Other expenses and deductions

not related to a

category of income .............

00

(2ci)

(ii) Gross income subject to tax

from all sources

(See instructions) ..............

00

(2cii)

(iii) Percentage of gross income subject to tax from

sources of the country, territory or possession

(Divide line 1(h) by line 2(c)(ii). Enter the result

%

%

rounded to two decimal places) .........................

%

%

%

(2ciii)

00

00

(iv) Multiply line 2(c)(i) by line 2(c)(iii) .....................

00

00

00

(2civ)

d)

Total deductions and losses

00

00

(Add lines 2(a), 2(b) and 2(c)(iv)) ...........................

00

00

00

(2d)

3.

Net income from sources of the country, territory or

00

00

possession (Subtract line 2(d) from line 1(h)) …......………

00

00

00

(3)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2